Kerby Anderson

Members of Congress who are currently resisting attempts to reform the tax code and reduce regulations should look at the recent Index of Economic Freedom. The United States has the lowest ranking ever in this index. For years, the U.S. was in the top ten. Now it sits at number 17. Countries with a higher ranking include Hong Kong, New Zealand, Switzerland, Estonia, Australia, Chile, and Canada.

Three of the many reasons for America’s decline in economic freedom are debt, taxes, and regulations. Annual deficits and a national debt approaching $20 trillion saddle the country with obligations that reduce its freedom. You can see this in your own life. If you have $30,000 credit card debt, you are less free to buy a new car, refinance your house, or go on a vacation.

The U.S. tax rate is another reason for the country’s decline in economic freedom. The top individual income tax rate is 39.6 percent, and the top corporate tax rate remains among the world’s highest at 35 percent. But even this high tax rate cannot keep up with government spending that last year amounted to 38 percent of GDP.

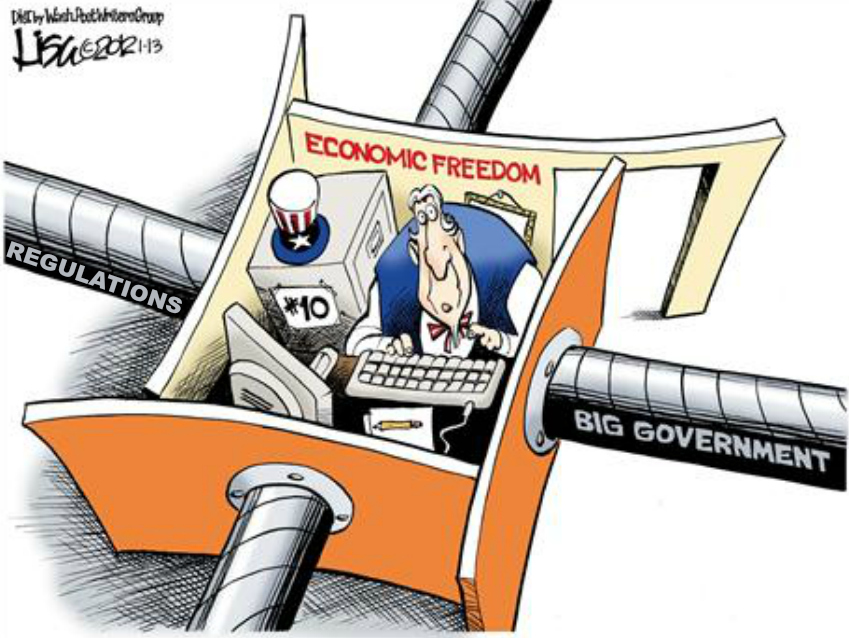

Burdensome regulations also reduce our freedom. One study concluded that our economy has been burdened with more than 20,000 new regulations since 2008. The added 572,000 pages to the Federal Register place an ever-increasing burden on small businesses. Another study found a net increase in new businesses in the late 1990s but a net loss of businesses in the last part of the first decade of the 21st century.

Will the current administration and Congress turn this around? Little has been said about reducing the debt. But President Trump has proposed tax reform and has used an executive order and other means to slightly reduce the regulatory burden. Perhaps the U.S. will rise in next year’s Index of Economic Freedom.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online