Kerby Anderson

Yesterday, I talked about inflation and increasing prices. Economists can debate whether inflation is on the horizon, but all of us can see that many prices are rising. And those percentage increases are greater than the Consumer Price Index (CPI).

Common sense and the ways we count our cents demonstrate that the CPI is not an adequate measure of inflation. Ten years ago, I wrote a commentary about the ways in which the government statistic varies from our daily experiences when we purchase goods and services.

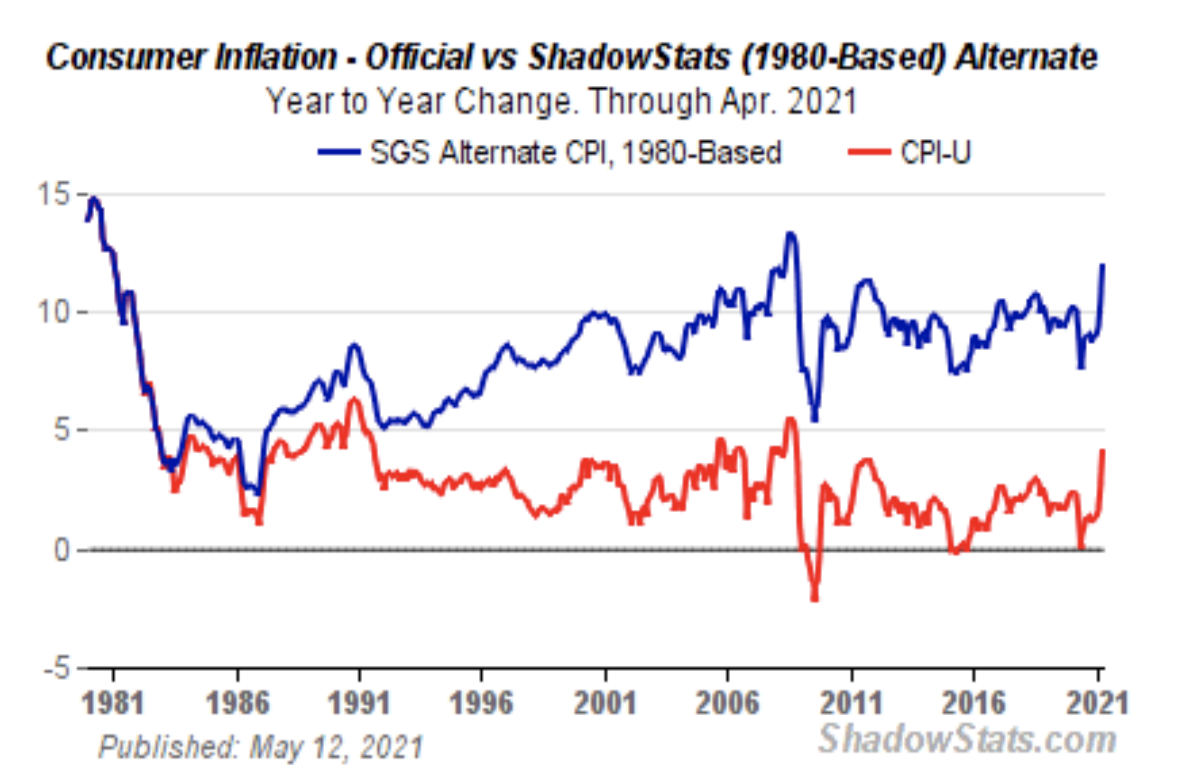

The federal government has changed the way it measures CPI many times, but the most significant change occurred decades ago. If you go to the Shadow Stats website, you will discover that if the government still measured CPI the same way it did in 1980, consumer inflation would be much higher.

The lower inflation number is a great benefit to the federal government. CPI is tied to the incomes of nearly 100 million Americans who receive Social Security, food stamps, Civil Service retirement benefits, and much more. Lower cost of living adjustments reduces the government’s financial commitments.

The CPI is calculated by measuring the cost of a basket of goods. Critics point out that certain costs are excluded. The government does this because these costs can be volatile and unstable. The government also will substitute less expensive products when the price rises too much.

Yesterday, I mentioned a few examples of rising costs. Increases in home values in many areas of the country are many times greater than the government’s listed inflation rate. The cost of higher education at many of the top-ranked schools is more than double the government’s listed inflation rate.

The list of rising prices of goods and services is long and rising. That is why we shouldn’t consider the CPI as a good measure of inflation.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online