By: The Editors – nationalreview.com – May 18, 2022

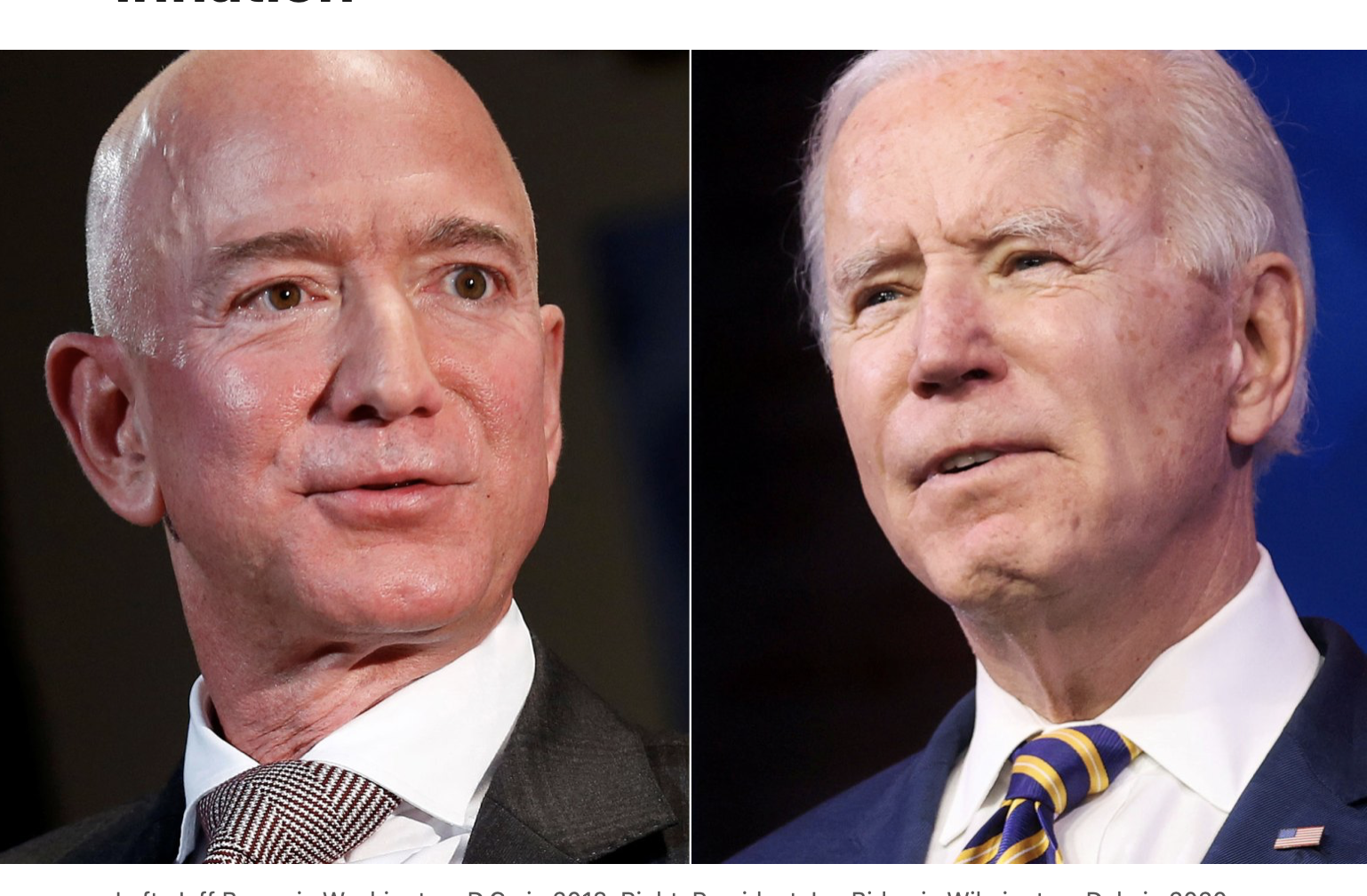

The Biden administration is in an entertaining public spat with what we might as well call the “Bezos administration” (Amazon’s annual revenue exceeds the GDP of most European countries), and, while our faith in the man who publishes the Washington Post is something quite a bit less than total, in this case Jeff Bezos is unquestionably in the right — and not just because the Biden administration has an uncanny knack for being wrong on every economic question at every possible opportunity.

Biden has proposed to fight inflation by raising corporate taxes. As Bezos was quick to acknowledge, there is a case to be made for raising corporate taxes (we are not persuaded by that case, but there is a good-faith argument there), and certainly there is a crying need for an anti-inflation policy — but to pretend that these are the same thing is economic illiteracy.

The Biden administration has an inflation problem — because America has an inflation problem — but the administration is by and large unwilling to do the things that are in its power to actually address that problem, because such measures are likely to be politically difficult for a White House in which the reflexive response to any problem is to throw money at it. Inflation is a problem that is famous for getting worse when you throw money at it, and for getting better when you stop.

As Bezos points out, Biden and many of his congressional allies tried to throw even more money at our already-overheated economy and were saved from their own worst inclinations only by the relative sobriety of Senator Joe Manchin, the West Virginia Democrat whose willingness to buck his party has made him, for the moment, the most powerful man in Washington. “They failed,” Bezos wrote, “but if they had succeeded, inflation would be even higher than it is today, and inflation today is at a 40-year high.”

Indeed, in the near term, putting new cost burdens on the firms that produce consumer goods and services would be a pretty good way to ensure higher prices for those consumer goods and services — the economics of “tax incidence” (how the economic burden of a tax actually gets distributed in the real world) can be pretty complex, but powerful firms reliably are inclined to pass along their expenses to consumers as well as to their vendors and employees. Everybody who has ever paid $10.81 after sales tax for a $9.99 bottle of bleach knows how that works — it is the consumer, not the producer or the seller, who pays the tax.

The United States already has a relatively high corporate tax rate, one that is a bit higher than the rates in high-tax Nordic countries such as Sweden, Finland, and Iceland, and significantly higher than the rates in such competitive European countries as Ireland and Switzerland. We lay a second tax on dividends, which are paid out of corporate income that already has been taxed once at the corporate rate.

The administration’s suggestion that Bezos’s criticism is only a cover for his disinclination to pay taxes is cheap demagoguery and deserves to be regarded with contempt. It is only the latest in a long line of contemptible inflation dodges: First it was “transitory,” until it wasn’t, and then it was the “Putin price hike,” even though the inflation started long before the war in Ukraine, and now it is Republicans or Jeff Bezos or — give it a couple of days — systemic racism. Anything other than the obvious: flooding the economy with money during a worldwide supply-chain disruption and keeping Covid-era emergency economic policies in place long after the economic emergency has passed.

Biden and other critics sometimes complain about “loopholes” in the tax code, which is strictly boob bait — in reality, the Biden administration loves special handouts written into the tax code: These are called “tax incentives,” and the administration proposes to create many more of them to reward politically connected businesses. The Obama administration couldn’t get enough of them, either.

Biden and other Democrats, notably Elizabeth Warren, have charged that this is an issue of “price gouging.” But big retailers are hurt by inflation as much as anybody — because they are buyers as well as sellers of goods. Walmart, for example, just announced that it missed its first-quarter earnings estimates because of higher prices for fuel, inventory, and labor. It is not the only firm facing such difficulties. Raising Walmart’s taxes at such a time is not the most obvious way to achieve consumer price stability.

Indeed, the Biden administration has no idea how that would work. When asked about how raising corporate taxes would combat inflation, the new White House press secretary, Karine Jean-Pierre, did an excellent imitation of a high-school student who hasn’t done the reading and gets called on to expound on Chapter 32 in Moby-Dick. It is hilariously painful to watch. The president himself often appears to be as lost as last year’s Easter eggs, but Jean-Pierre is if anything even more incoherent — the real world isn’t MSNBC, as it turns out.

But, back in the real world, the fact is that the prices of baby formula and gasoline are not going through the roof because billionaires are buying those commodities by the ton and need to be reined in. (We trust the yacht market will see to itself.) Taxing Elon Musk into penury is not going to affect the price of a pound of 93 percent lean hamburger at Trader Joe’s — and that price is the sort of thing that the Biden administration should be worrying about for both substantive and political reasons.

We do not have high hopes for the Biden administration and never have. But, ceteris paribus, we would prefer a Democratic administration that is wrong and serious to one that is wrong and preposterous. And the Biden administration’s approach to inflation has, so far, been nothing short of preposterous. The intellectual laziness and moral cowardice of this administration are extraordinary, and Americans are paying a very high price for them.

To see this article, and subscribe to others like it, choose to read more.

Source: Inflation: Raising Corporate Taxes Won’t Reduce Consumer Prices | National Review

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online