Here’s a suggestion. Read Article I, Section 8 of the Constitution and then compare it to the government we have today. The framers set forth what is the legitimate role for the federal government.

You will find that it does give the government power to collect taxes and duties. It is required to provide for the common defense and general welfare of the United States. It can coin money, establish post offices and roads. That’s about it.

Professor Walter Williams in his new book, American Contempt for Liberty, reminds us that: “Nowhere in the Constitution do we find authority for Congress to tax and spend for up to three-quarters of what Congress taxes and spends for today. In other words, there is no constitutional authority for farm subsidies, bank bailouts, food stamps, Social Security, Medicare, and thousands of other federal spending programs.”

The point he is trying to make is the current government is a significant departure from the original principles of limited government and individual freedom. And we are paying heavily for this expanded government.

He estimates that at the turn of the last century (1902) expenditures for all levels of government were $1.7 billion. The average taxpayer paid only $60 a year in taxes. Today federal expenditures alone are nearly $4 trillion, and the average taxpayer pays more than $10,000 a year in federal, state, and local taxes.

You can look at it another way. From the beginning of the country (1787) until 1920, federal expenditures were only 3 percent of GNP. Today federal expenditures are nearly 25 percent of GDP.

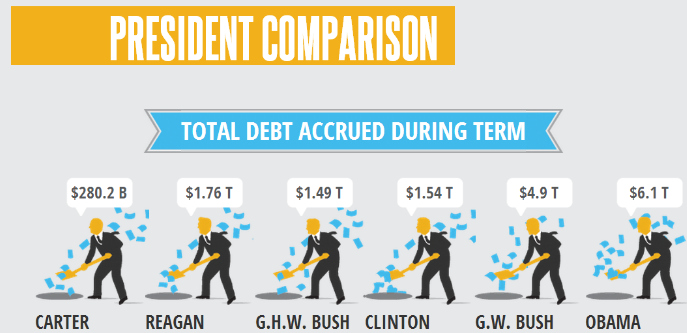

As bad at this trend is, we need to remind ourselves that government is spending more than it is receiving in taxes. Each day America goes deeper into debt. We have exceeded $18 trillion in debt and show no signs of balancing a budget any time in the future.

It is worth remembering these facts when evaluating candidates for federal office. I’m not interested in a politician that wants to keep driving down this road. It’s time to stop and turn around.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online