Kerby Anderson

Kerby Anderson

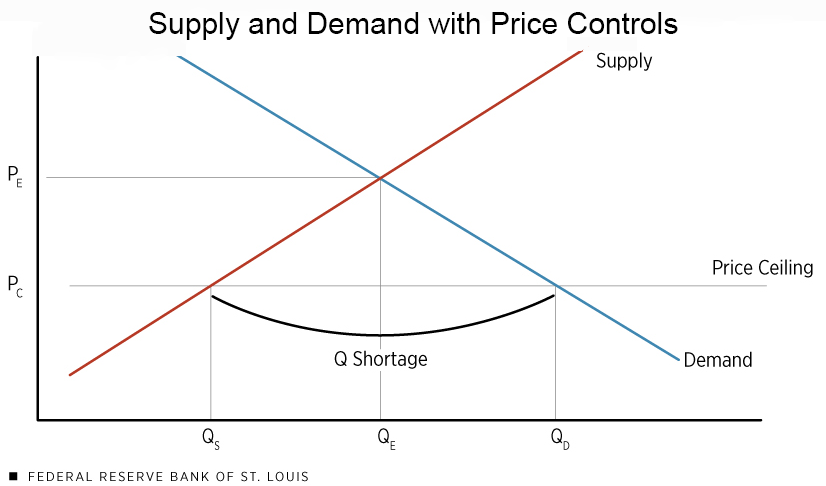

Yesterday, I talked about why price controls are a bad idea, and I thought I might continue by looking at two policies being proposed to attract young voters: student loan debt and housing prices.

Let’s start with a simple statement about supply and demand. If you want to lower prices, you need to increase supply and/or decrease demand. Unfortunately, colleges aren’t governed by a free market of supply and demand. That is why the cost of tuition has risen twice the rate of inflation over the last few decades.

Demand for higher education might be going down due to one surprising demographic fact. Fewer children were born during the Great Recession years of 2008 to 2011. There will be a 15 percent decrease of potential students.

However, colleges won’t reduce their costs because both the federal government and state governments are giving students and their parents scholarships and loans. And President Biden has been cancelling billions of dollars in student loan debt, essentially signaling that students won’t have to pay back the loans they are taking out this year.

The principle of supply and demand also works in housing. When there aren’t many houses for sale, the price goes up. President Biden has called for building 2 million housing units, and Vice-President Kamala Harris has now called for building 3 million units.

To achieve this, the Harris campaign talks about offering expanded tax credit to home builders. The campaign, however, also proposes a $25,000 subsidy for first-time homebuyers. This would increase demand and not bring home prices down.

Giving money to students and giving money to home buyers seems like a good idea until you get back to basic economics. Understanding supply and demand is necessary to evaluate campaign promises.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online