Kerby Anderson

In his new book, The Big Print, Larry Lepard provides an overview of the economic history of America but also issues a warning. We are headed for a “big print.” He means the only way out of our current debt cycle will be for the government and the Federal Reserve to print more money.

He demonstrates this with his chapter “Nothing Stops This Train.” The phrase was first popularized by Lyn Alden, who is the author of another important book on our Broken Money. He uses this metaphor to explain our options: “As America’s fiscal train thunders toward a fateful switch in the tracks, ahead lies either system collapse from unstoppable debt momentum or a sharp angle toward painful but purposeful economic realignment.”

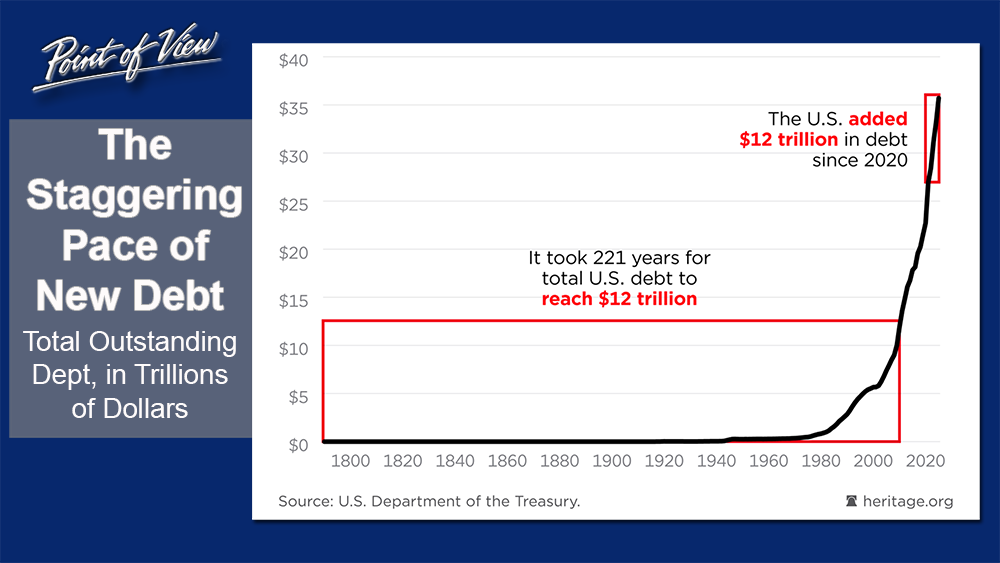

Many of his graphs document his concern. One graph he uses (that I have cited in the past) comes from the Heritage Foundation that illustrates “The Staggering Pace of New Debt.” It documents that it took 200 years for the U.S. debt to reach $11 trillion, and yet the country has added $11 trillion since 2020. He also posted a Washington Post headline: “U.S. National Debt Spiraling Out of Control, Rising $1 Trillion Every 100 days.”

When the U.S. debt is substantially larger than the U.S. GDP and the government interest on the debt is larger than the defense department budget, you don’t have many options. Austerity was one option, but the backlash to DOGE shows how tough it would be to just get a balanced budget.

Money printing will be inflationary. Last fall, legendary investment advisor Paul Tudor Jones stated the obvious on CNBC: “All roads lead to inflation.” As I mentioned yesterday, a wise person will be prepared.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online