By: Hank Adler – townhall.com – December 3, 2017

Anyone who reads my commentary on Townhall.com knows that I believe there are areas of the Senate & House tax reform bills that could be improved. I am especially concerned about the general elimination of the casualty loss, but I am firmly convinced that the first time there is another Bernard Madoff, and there will be another Bernard Madoff, the casualty loss provisions will be legislated back into the law.

Prior writings to the contrary, the Senate tax bill is a tremendous step in the right direction in tax reform. In reality, it is a bill that has sections that should cause celebration in the Democratic Party. The reduction in the corporate tax rate should be causing late night parties in blue states and cities where pension plans have been underwater for years. It is pension plans that invest most heavily in the stock market. It is the pension plans of government and union workers that benefit from a stock market that has increased in value by 33% in the past year. It is the citizens of blue states that have and will benefit by the resurgence in the stock market as underwater pensions are now less underwater. Corporations don’t benefit from lower tax rates, shareholders benefit from lower tax rates that produce higher income. It is American pensions that own our stocks and bonds.

Lower corporate tax rates should result in corporate expansion and more jobs. Who could be opposed to this result?

The $24,000 standard deduction and lower rates benefit renters as well as homeowners with mortgages under $200,000. Certainly, there are millions of Democrats that have this specific financial demographic. The expansion of the child care credit has to be viewed as a positive change from the Democratic viewpoint.

College students and former college students are not hurt by the Senate tax reform package. The credits available for undergraduate students and the deductibility of student loans are untouched. The estate tax does not go away and the arguments about saving the family farm, albeit very flimsy under the current estate tax, disappear. The super wealthy will continue to be subject to an estate tax.

On the conservative side, the near elimination of deductions for state and local taxes puts an element of fairness into the Internal Revenue Code. The reality is that if blue states wish to have sensational social programs, these are decisions made by the voters of blue states. There is no reason the citizens of the State of Texas should subsidize the welfare programs of New York. While there will be increases in taxes to many Californians (including me) and New Yorkers, we get to choose where we live. We get to make political contributions to change political leadership if we so choose.

The Individual Mandate goes away. This is a step toward individual freedom and a good step. If a taxpayer does not want to have health insurance and wants to take the risks attendant thereto, why not? This is an American thought process. The less the government makes us do, the more freedoms Americans have, no more, no less.

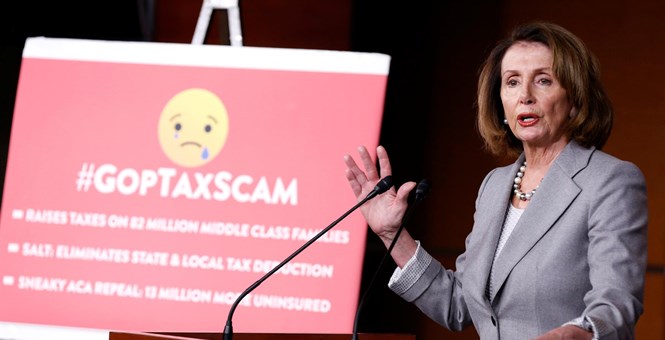

So what is Ms. Pelosi upset about? The saddest part of government today is that Ms. Pelosi obviously believes that her role is to say the sky is falling if President Trump and Republicans are succeeding in passing any legislation. That is a tragedy. With respect to tax reform, a solid argument could be made that the tax bill proposed by the Senate could, in great part, have been a tax bill proposed by the last remaining conservative Democrats. There is much to like for both Republicans and Democrats.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online