By: Stephen Moore – washingtontimes.com – April 29, 2018

ANALYSIS/OPINION:

I have argued many times on these pages, and elsewhere, that the shale oil and gas revolution is the story of the decade. Since 2007 U.S. oil and gas output has risen by about 75 percent and the renaissance is still in its infancy stages.

This year the surge in domestic energy production has further accelerated in part due to higher world prices for oil (approaching $70 a barrel) and to massive drilling operations in rich oil patches like the Permian Basin in Texas and in the Bakken Shale in North Dakota.

The Energy Information Administration reports that the U.S. could surpass Saudi Arabia in oil and gas by the end of the year. With massive oil and gas shale reserves, we could be No. 1 in the world before the end of the decade.

The Wall Street Journal confirms that U.S. output is “expected to surpass Saudi Arabia by the end of the year” and we will rival Russia for No. 1 in the world. American production will rise to almost 11 million barrels a day, the most ever in American history. Doesn’t it seem like yesterday when the left was running around shrieking about “peak oil?” More like peak idiocy.

Last week Reuters argued that the American shale boom should be called “Donald Trump’s Revenge.” The story reported that “U.S. oil now floods Europe at the expense of OPEC and Russia.” Couldn’t have happened to a couple of nicer guys. America is now selling more than one-half million barrels a day thanks in no small part to the end of the oil and gas export ban in 2016.

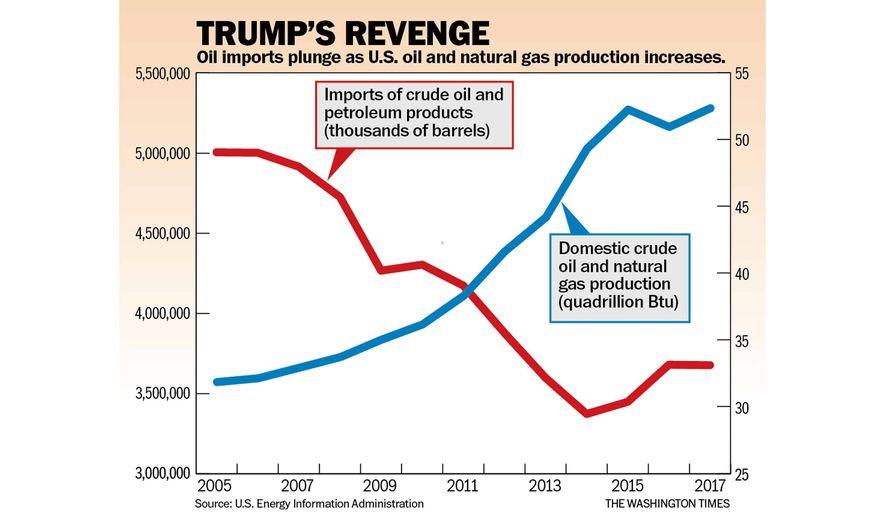

What all of this means is that we are getting very close to the day when America returns to becoming a net exporter of oil. This would reduce our trade deficit by more than $200 billion a year. The chart below shows the precipitous decline in imports over the past decade. Saudi Arabia is still a major player in the market that can move the world price by turning on and off their spigots. The recent spike in gas prices to more than $3 a gallon is due to Russia and Saudi production cuts. But the OPEC nations can no longer hold the world hostage, as it did in the 1970s when we had gasoline lines and price controls and had to bow to the Saudi oil sheiks.

What a difference a president makes. Mr. Trump has been all in on encouraging fossil fuel production. He’s freeing up federal lands in places like Alaska for drilling, allowing permits for new pipelines and relaxing some of the anti-fracking regulations that were enacted in the Obama years. As Harold Hamm, the CEO of Continental Energy, which owns much of the Bakken Shale in North Dakota, recently told me: “It makes a big difference when you have a president who actually LIKES your industry.”

One idea that is floating around on Capitol Hill now is to use the royalties and lease payments from drilling on federal lands to reduce the trillion-dollar annual budget deficit. This is essentially free money to Uncle Sam and by some estimates these payments could exceed $1 trillion over the next decade. Why not?

Only a few years ago Mr. Obama told the nation that “we use 20 percent of the world’s oil but we only have 2 percent of the world reserves.” He was only off by well more than an order of magnitude on our nation’s share of world supplies.

Mr. Trump has always had a much more optimistic and realistic world view. He says he wants to “make America energy dominant,” and after a little more than a year in office we are on our way.

To see this article, click read more.

Source: Goodbye, OPEC – Washington Times

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online