Kerby Anderson

Inflation may not be good for most Americans, but it certainly helps the federal government. The editors of the Wall Street Journal put it this way: “The country may be upset with inflation, but in many ways political Washington has never had it better.”

The pandemic has been an “excuse for record government spending and the abuse of regulatory power such as vaccine mandates and an eviction moratorium.” But there is another reason. Increasing income tax revenues have been pouring into the federal treasury.

Federal receipts from the first fiscal quarter (October to December) have increased by a remarkable 31 percent. In other words, that is an increase of $248 billion to $1.05 trillion for the quarter. Much of the increase comes from individual income taxes, while much of the rest comes from an increase in corporate income taxes.

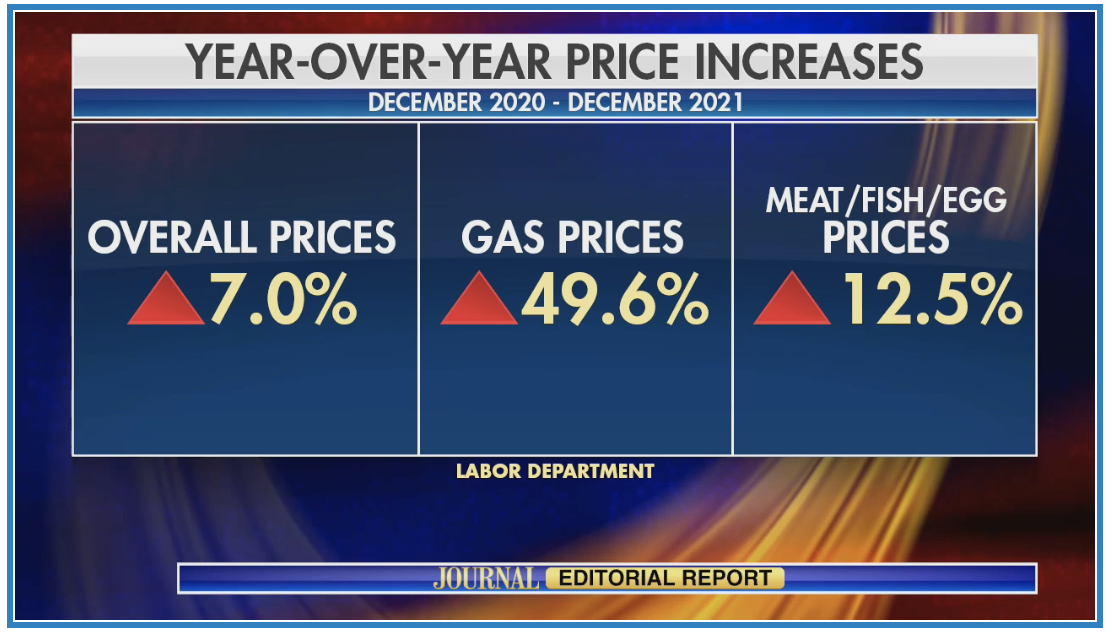

The reason for those increases is easy to explain. Inflation increases the nominal GDP. In fact, the seven percent increase in inflation led to an increase in the nominal GDP by double digits. That leads to higher nominal profits, wages, and salaries.

With such an increase in income to the federal treasury, you might expect that we would be closer to balancing the federal budget. But you probably already know the answer to that assumption. The federal government still had a $377 billion budget deficit in the first fiscal quarter because federal expenses increased.

That fact should be enough to explain why the federal government doesn’t need a tax increase. We can’t even balance the budget when an unexpected $248 billion comes into the federal treasury.

This fact should also explain why government officials aren’t rushing out to deal with inflation. Inflation may not be good for you and your family, but it has been very good to political Washington.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online