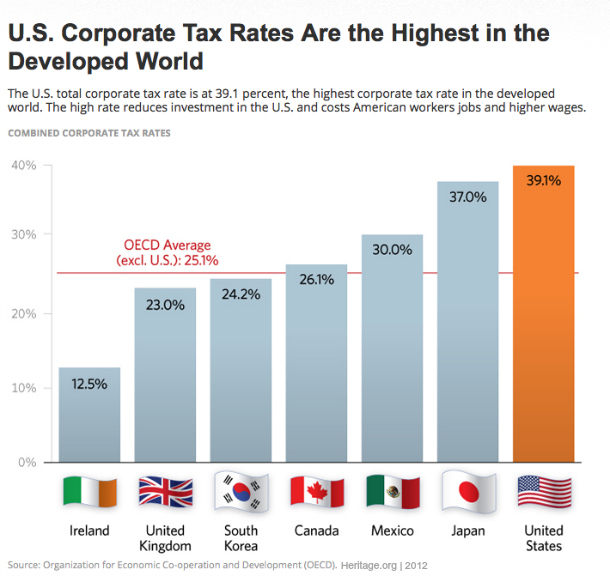

Let me start with a troubling statistic. America has the highest corporate income tax in the world. When you think of all the countries of the world, some with free markets and many without, it is hard to justify a corporate tax rate of 35 percent. At the very least, many reformers are suggesting that we could have a tax rate in line with the average in other countries, which is about 23 percent.

As I have mentioned in previous commentaries, the corporate income tax was proposed as an alternative tax. Congress tried to pass a personal income tax in the 19th century, but the Supreme Court declared that action unconstitutional. So in the early 20th century, Congress passed a tax on corporate profits as an indirect way to force rich people to pay their fair share in taxes. When the 16th Amendment was passed and a personal income tax was established, Congress could have repealed the corporate income tax, but it did not.

In his column in the Wall Street Journal, John Steele Gordon gives “10 Reasons to Abolish the Corporate Income Tax.” Let me just mention a few. First, it would simplify the tax code that is more complex than ever before. There is a reason for that. Corporations hire an army of lobbyists who work with members of Congress to get favorable tax treatment for these corporations. That is why we hear every year about major corporations who paid no taxes in the previous year while small businesses without lobbyists and influence pay 35 percent.

Second, the U.S. economy would receive an instant cash windfall. In previous commentaries I have talked about the fact that at least $2 trillion of foreign earnings by U.S. companies is held overseas. If they no longer had to pay a 35 percent tax, this money would be quickly repatriated. This tsunami of new capital would drop interest rates. Companies would most likely use the money to invest in equipment and new technology.

For these and many other reasons, a lower corporate tax rate would be a significant boon to the American economy.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online