Kerby Anderson

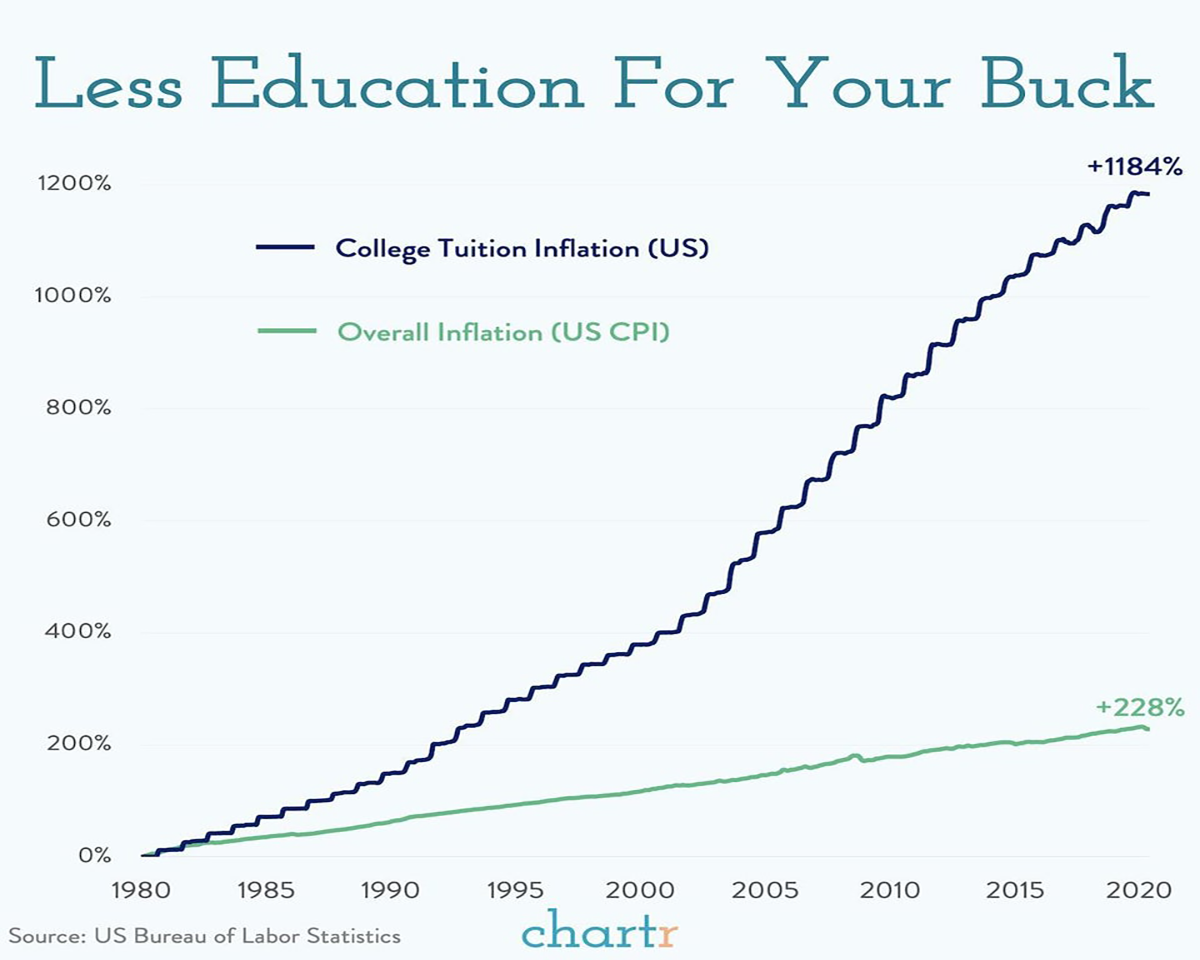

As college students arrive on campus, they confront the “sticker shock” of college tuition. Although lots of comments have been made about President Biden’s plan for student loan debt forgiveness, the real problem has been the rising cost of college tuition.

Notice two things are not said by the administration and by those who support student loan forgiveness. No one is saying that the decision won’t cost taxpayers very much. The University of Pennsylvania Wharton School concluded that the student-loan bailout will cost between $600 billion and more than $1 trillion (much more than the cited figure of $300 billion). Also, no one is saying that this policy will bring down the cost of higher education.

Star Parker, in her commentary, argues that government is not the solution to rising college costs but is the reason for way-out-of-line tuition costs. Let’s start with some of the facts. From January 2000 to June 2020, the cost of college tuition and fees increased by 178 percent. The overall rate of price increases during that same period was 74.4 percent. In other words, college costs rose at more than twice the rate of inflation during that same period.

When the government provides student loans to college students and then forgives those same loans, there is little incentive for colleges and universities to “tighten their belts” and look for ways to cut costs. Senator Ben Sasse previously served as the president of Midland University and understands the economics of higher education. He argues in a recent article that we shouldn’t be “wiping the slate clean on student debt.” Instead, “Washington should take a hard look at reforming a broken system.”

Star Parker is correct. Government isn’t the solution to higher college costs but instead, government is the reason.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online