Kerby Anderson

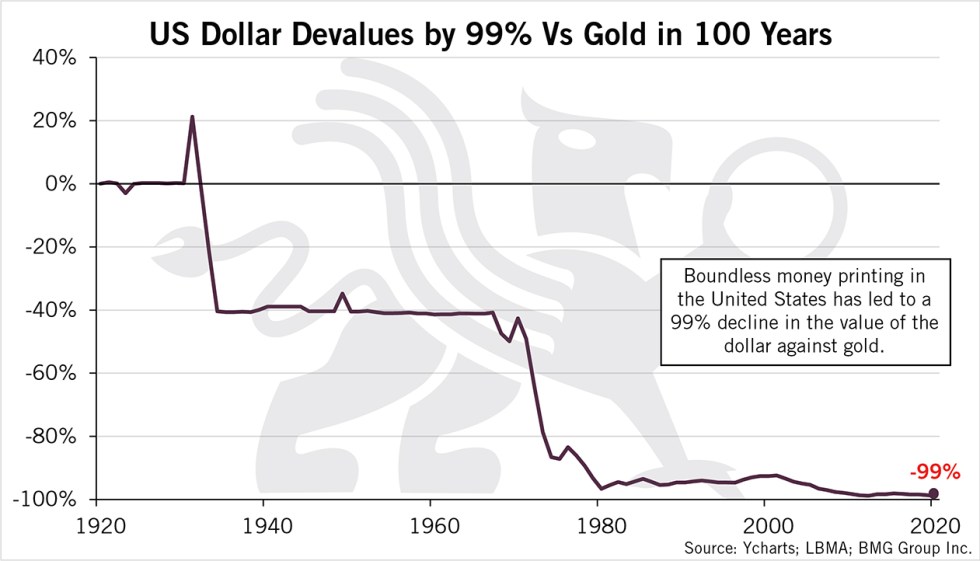

In previous commentaries, I have talked about the dollar’s loss of value. We often provide a chart that was generated by the Bureau of Labor Statistics. It shows that the dollar has lost 95 percent of its purchasing power.

In a recent keynote speech in Prague, Michael Saylor (MicroStrategy) put together a presentation with numerous graphs. They show even more accurately the decline of the dollar as well as the decline of other currencies around the world. His YouTube presentation makes a powerful statement.

For example, he has one slide that shows that the US dollar loses 99 percent of its value when compared to gold (1923-2023). Gold is not scarce. More of it is pulled from the ground each year. He then shows another graph of something even more scarce. The US dollar loses 99.8 percent of its value compared to the 50 most valuable companies in the S&P (1923-2023).

This is worse for other countries because foreign currencies are collapsing against the dollar. The Argentine Peso (ARS) loses 99.9 percent versus the dollar (2001-2023) in the last twenty years. His chart shows that the Turkish Lira loses 95 percent versus the dollar, but its latest loss is probably 97 percent. And the Indian Rupee loses 90 percent versus the dollar since 1980.

This puts our current financial circumstances in some perspective. The dollar is like a melting ice cube. The value is declining every year. But imagine what it is like to live in many of these other countries with even more inflation and currency declining in value.

He concludes by showing a chart of asset performance since August 2020. Those percentages show how to preserve your wealth in a world where currency is declining in value.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online