Kerby Anderson

Over the years, I have written about how people in high tax states have been migrating to low tax states. Unfortunately, many politicians in those states want to argue that tax rates don’t affect investment or even migration. The latest data from the IRS once again demonstrates tax migration.

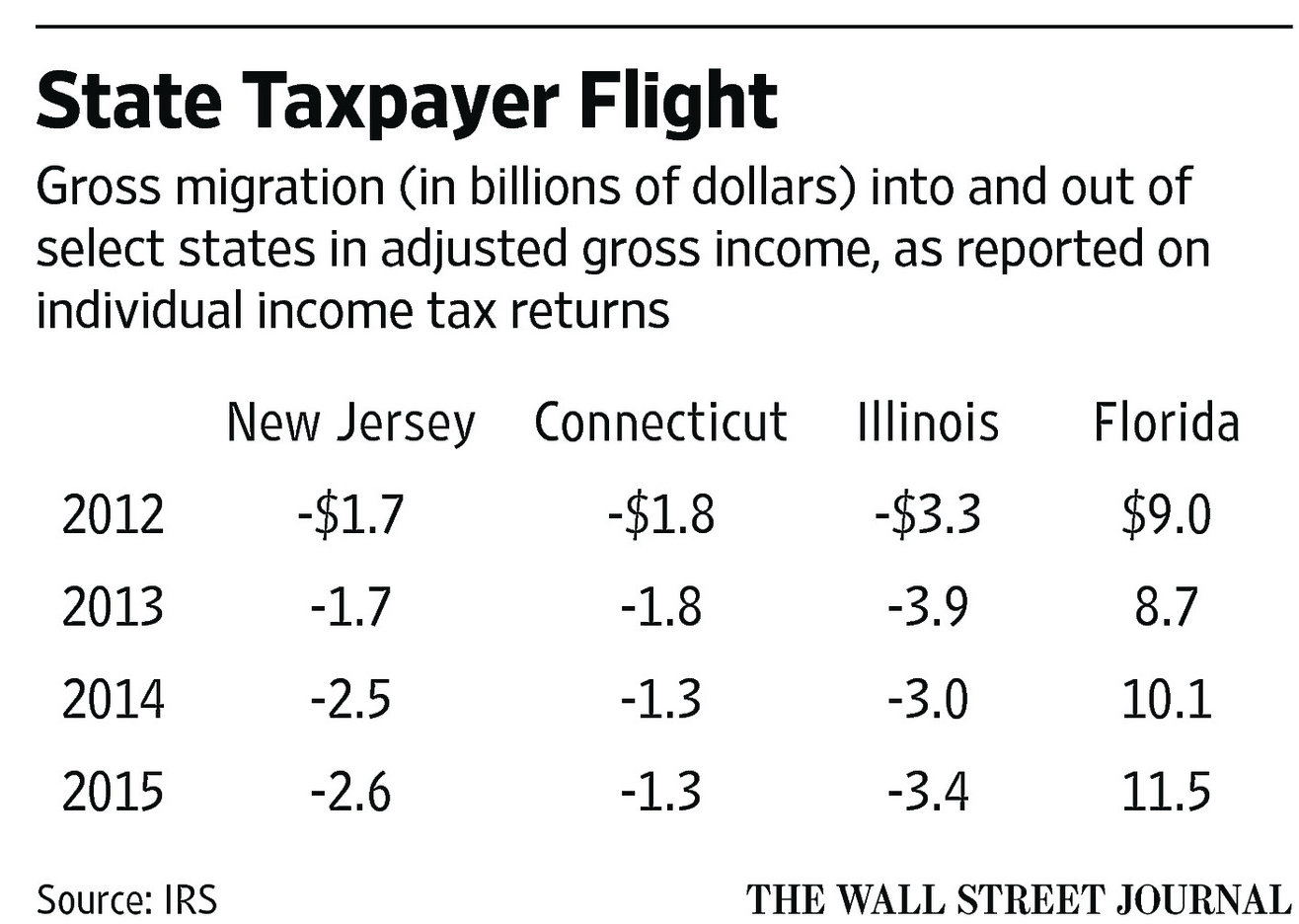

Between 2012 and 2015, a net of $8.5 billion in adjusted gross income left New Jersey and $6.2 billion left Connecticut. Illinois, for example, lost $13.6 billion. However, during that same period, Florida (with no state income tax) gained $39.3 billion in adjusted gross income.

You can even see tax migration between high tax states. As an editorial in the Wall Street Journal puts it, “income flows down the tax gradient.” New York lost a net $850 million in adjusted gross income to New Jersey and Connecticut. At the same time New Jersey gave up $335 million to Pennsylvania.

It might be tempting for politicians wanting to raise taxes to write off this tax migration to merely another example of snowbird flight. After all, people have been moving from the northeast to Florida for decades. But the examples I just cited show this to be more than just migration to a warmer climate. It is a migration to low tax states.

The tax migration, especially of the affluent, has had a negative effect on state budgets. Revenues have fallen short in states like New Jersey, Illinois, and Connecticut. That has resulted in budget deficits that have forced legislatures to cut public services and funds to local government. The local governments have responded by raising property taxes thus increasing more tax migration.

All of these facts and figures are a reminder that people vote with their feet when you tax their pocketbooks.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online