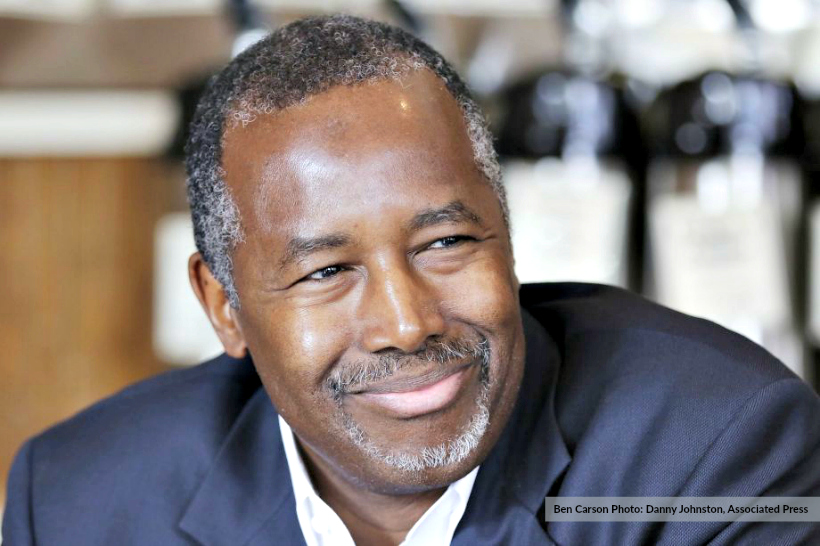

Many candidates talk about trying to implement a flat tax. One presidential candidate actually is proposing a true flat tax. Ben Carson’s tax proposal has received high marks from a number of economists even though it is unlikely that it will be implemented since his candidacy seems to be fading. Nevertheless, it is worth talking about his flat tax plan because it reminds us how far off our current tax system is from a system that would be flat, fair, and simple.

He is proposing a flat tax of 14.9 percent on personal and corporate income that he says has “no deductions, no tax shelters, and no loopholes.” He is right about that. It would even eliminate the popular deductions for mortgage interest and charitable deductions. He would exempt taxpayers earning up to 150 percent of the federal poverty line. And he would ask even those people to make some “de minimis” payment each year so they would be treated as “citizen owners.”

Such a plan would be a tough sell because Americans have unfortunately been willing to let the tax code dictate economic behavior. Certain industries and businesses should not receive deductions simply because they hire lobbyists. Home owners shouldn’t be given a deduction just because they own a home. I do think it would be possible to explain to people that they would be better off if they just had to pay a flat tax and didn’t have to worry about all the tax preparation and paperwork.

If we could get Congress and the American people to try it as an experiment, most would see how the current tax system is rigged against the average person. Everyone would be paying into the system. And I like his idea of have even people who don’t have to pay taxes to give something (their time, talent, or treasure). Everyone should contribute to society, even if it is merely to donate a can of food to a homeless shelter.

Ben Carson’s flat tax is a good idea, even if it will never be implemented.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online