Kerby Anderson

One of the many themes being debated during this campaign season is income inequality. It is often the justification used for raising taxes and redistributing income.

We can certainly have a moral debate about what we should do (if anything) about the differences in income, but first we need to have accurate numbers. Former Senator Phil Gramm and former commissioner John Early took the time to provide “The Truth About Income Inequality.”

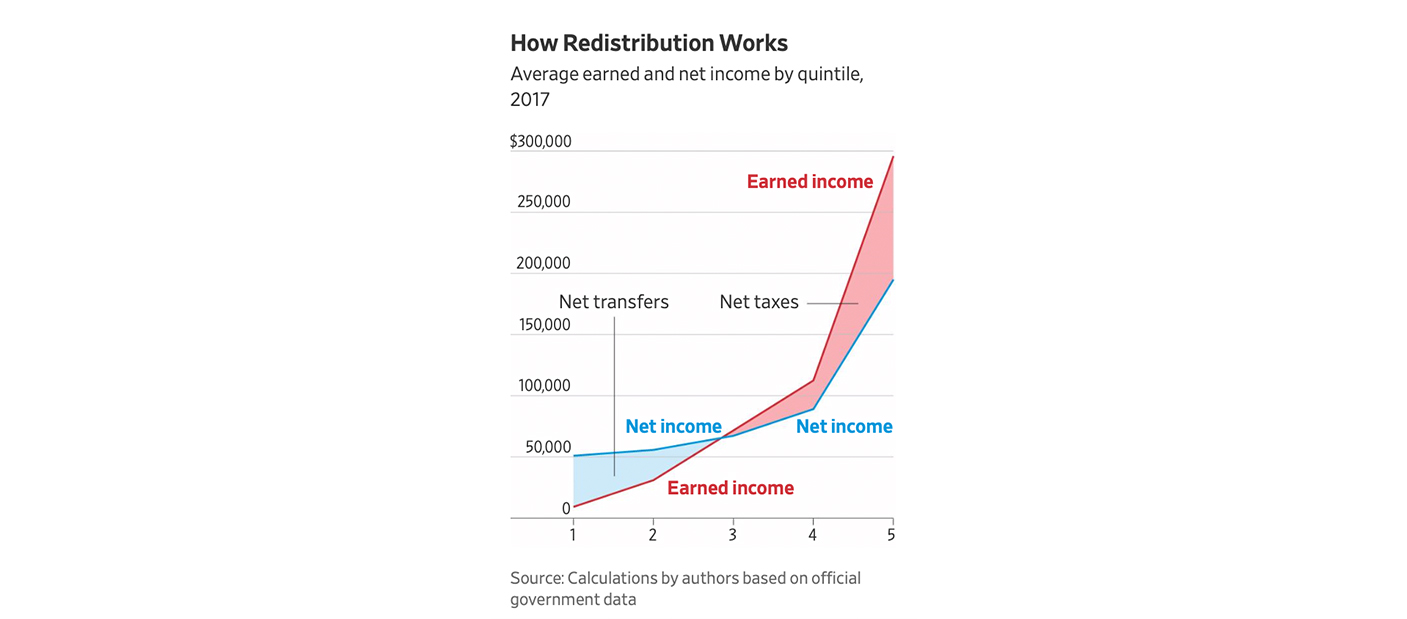

Census Bureau data fails to account for two very important facts. First, the richest people in America pay almost two-thirds of federal, state, and local taxes. Gramm & Early conclude that “ignoring the earned income lost to taxes substantially overstates inequality.”

Second, the Census Bureau data also “fails to count $1.9 trillion in annual public transfer payments to American households.” That includes transfer payments from 95 federal programs such as Medicare, Medicaid, and food stamps. They conclude that by leaving out taxes and transfer payments it overstates inequality in America by more than 300 percent. “More than 80% of all taxes are paid by the top two quintiles, and more than 70% of all government transfer payments go to the bottom two quintiles.”

They also conclude that the average bottom-quintile household receives $45,389 in government transfers and an additional $3,313 in private transfers from charitable and family sources. That means the average household in the bottom quintile has $50,901 in available resources.

This recent article is a reminder that before we have a debate about a topic like income inequality, we need to get the right economic facts on the table.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online