Kerby Anderson

Eight years ago, I was writing about the decision by the IRS to deny tax-exempt status to a few Tea Party groups. Back then, Lois Lerner served as the IRS Director of Exempt Organizations. She may no longer be working at the IRS, but there are other bureaucrats who have an even more bizarre notion of what can be designated as a tax-exempt non-profit organization.

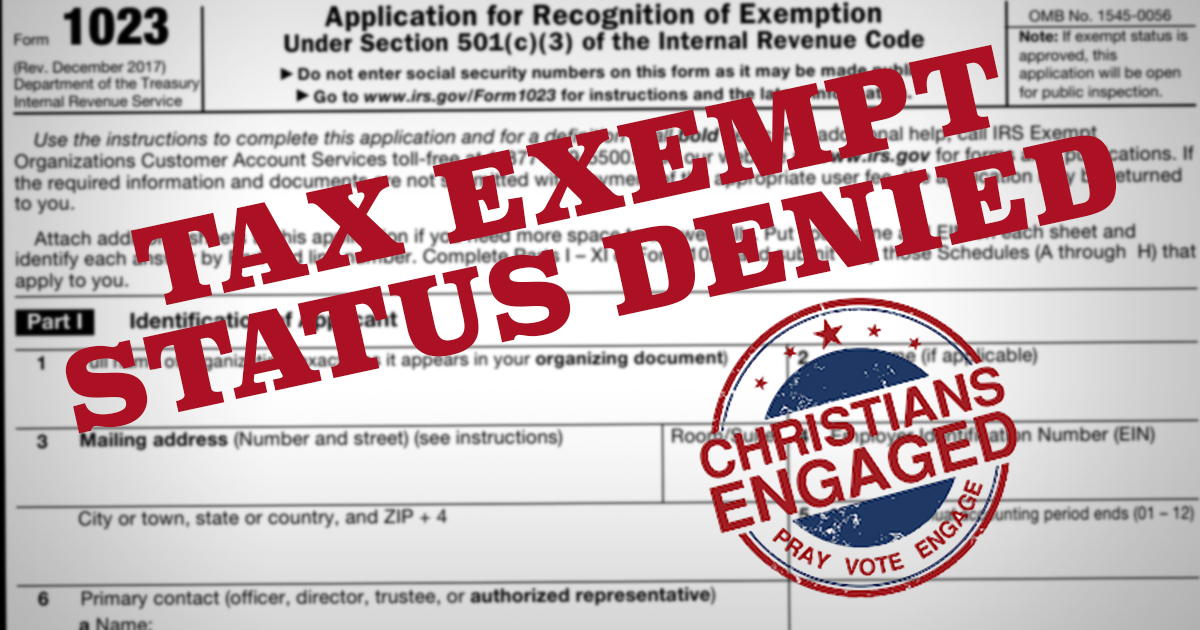

The group Christians Engaged was formed to educate and empower Christians to pray for the nation and elected officials and encourage Christians to be civically involved. The founder has worked as a campaign manager for former Representative Jeb Hensarling and even ran for Congress herself.

The letter from the IRS denied Christians Engaged tax-exempt status because it includes Bible teachings that it alleges are “typically affiliated with the [Republican] party and candidates.” What are those controversial teachings? Those would be such issues as “the sanctity of human life, the definition of marriage, biblical justice, freedom of speech” and other similar topics.

As one commentator noted, this is a bizarre view that “biblical values are exclusively Republican. That might be news to President Joe Biden, who is often described as basing his political ideology on his religious beliefs.”

One other point is relevant. I would suspect many of you are hearing about this for the first time because the establishment media didn’t cover it. But turn this around. Imagine if Black Lives Matter started an educational affiliate but was denied tax status during the Trump administration because its views were like those of the Democratic party. Do you think the press would have covered that decision?

This decision is being appealed, and I believe it will be reversed. But I suspect we will see more of this in the future.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online