Kerby Anderson

You have probably chanted at one time or the other: “We’re number one.” But sometimes being number one isn’t something positive. If the legislation before Congress passes, the United States would be number one in taxes.

The Tax Foundation calculated combined tax rates for individual incomes across major nations. If you look at their chart, you will see that currently the US is in the middle with tax rates comparable to Switzerland, Turkey, Spain, and the UK. Under the current plan in Congress, the combined US tax rate would climb significantly and leap over every other country in the developed world.

Even with these high taxes, the federal government would still not be able to pay for all the spending in this legislation. One reason is the economic fact that when you raise taxes, you don’t always raise more tax revenue. Individuals and companies will focus their economic activities and investments elsewhere.

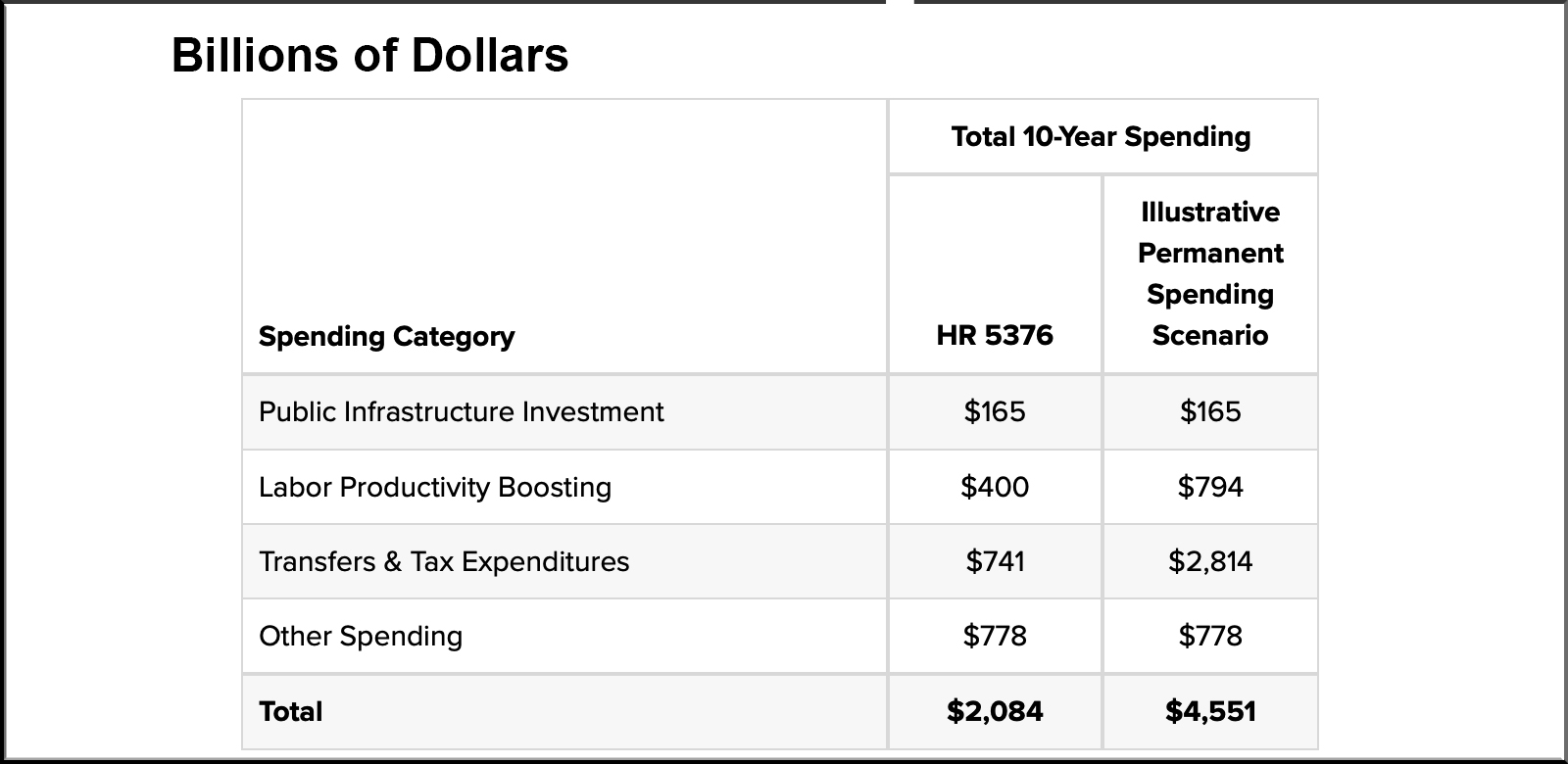

But a more important issue is that this legislation will cost much more than advertised. We are told that the bill will cost $2 trillion. And proponents point to a recent cost estimate from the Congressional Budget Office. But they are forced to score the bill under the budget tricks and gimmicks that really disguise its true cost.

The Penn Wharton Budget Model estimates the cost at $4.6 trillion over ten years (assuming temporary provisions become permanent). The Committee for a Responsible Federal Budget puts their estimate at $4.9 trillion (if the tax credits and programs are made permanent).

Democrats in the House and Senate won’t tell you some of these important facts. Most of the establishment media won’t tell you this either. But I just did. I am convinced that most Americans would be against legislation that would make us number one in taxes and yet not even come close to paying for it.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online