Kerby Anderson

Kerby Anderson

Today is usually Tax Day, but the IRS says we don’t need to have our tax forms in until Monday.

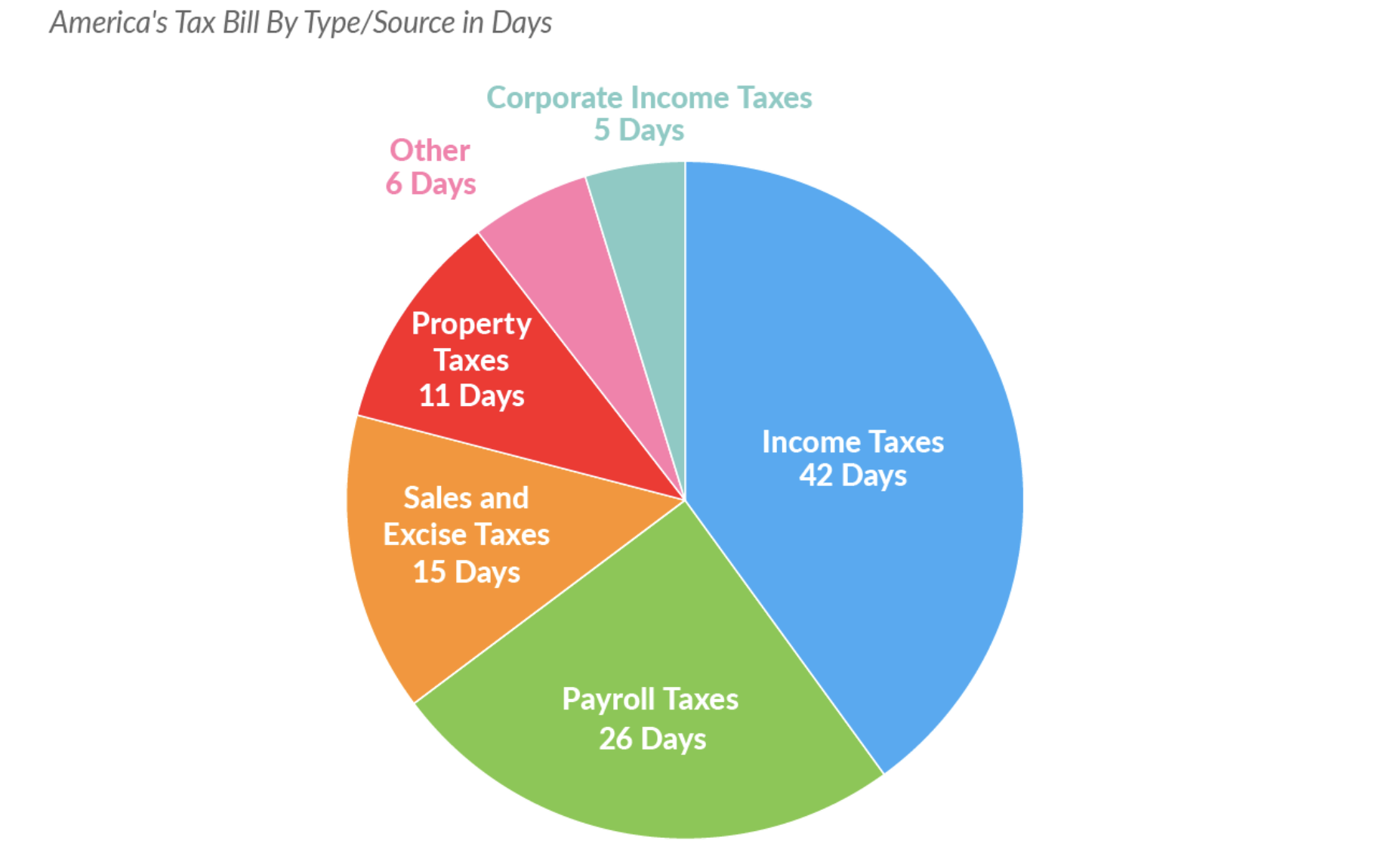

A more important date is Tax Freedom Day. That is the date when your tax burden is lifted. It is calculated by dividing the official government tally of all taxes collected in each year by the amount of all income earned in each year. Put another way, it is when you are no longer working for the government but are now working for yourself and your family.

This year Tax Freedom Day occurs on April 18. And remember this is an average. Citizens in states like Louisiana already have had their Tax Freedom Day. Citizens in New York have to wait until the middle of May for their Tax Freedom Day. Let me also add that Americans will pay more in taxes than they will spend on food, clothing, and housing combined.

There is one more date worth mentioning. It is called Cost of Government Day. This is the date on which the average American has paid his share of the financial burden imposed by the spending and regulation that occurs on the federal, state, and local levels. This date occurs a few days after the 4th of July. This date is a little less precise since it is difficult to calculate all the costs of government regulations.

Even so, the Cost of Government Day really puts things in perspective. It takes a little more than half of the year to finally get government off your back so that you can begin to earn a living for you and your family.

Both of these dates help us realize what is happening around us. There is a cost, but often we don’t see it. Our taxes are withheld from each paycheck, so we often don’t think about what we are paying. And since the cost of most regulations is hidden, we don’t see those costs either. But imagine if we had to pay all our taxes in one lump sum. You can bet there would be an outcry.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online