Kerby Anderson

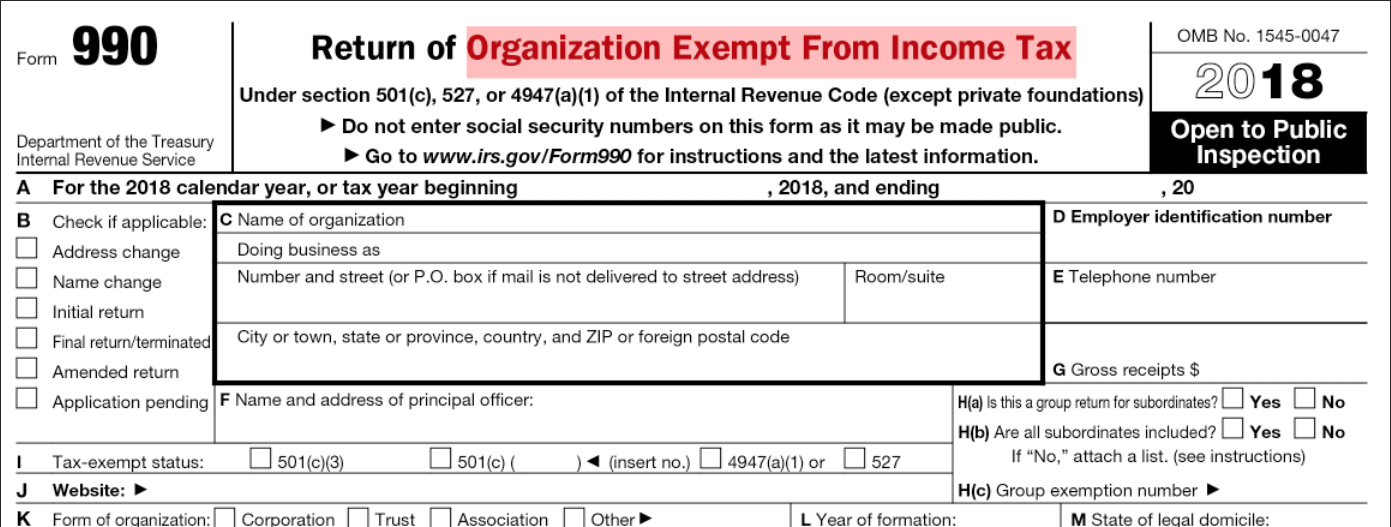

Should the federal government start pulling the tax-exempt status of religious organizations? Most Americans reject the idea, even though it was floated by a former presidential candidate who argued that “no reward, no benefit, no tax break” should be given to certain religious institutions. Unfortunately, you can find a significant number of other Americans who agree with his sentiment.

That is why I think it is time to have a discussion about the tax-exemption given to churches and other non-profit organizations. Most Americans do not have any idea why the government grants tax-exemption nor do they have much appreciation for the benefits these organizations provide for society.

For example, there are approximately 350,000 religious congregations in this country. The vast majority of them provide various community services for people in need in their communities. One survey estimated that the economic impact of faith in America is around $1.2 trillion. Another study concluded that religious organizations save the government $2.67 trillion in social services.

A few years ago, I quoted an author who suggested that all Christian institutions go on strike. It was more of a thought experiment, but it once again illustrates the benefit society receives from Christian influence. Imagine if Catholic, Presbyterian, Methodist, and Baptist hospitals closed down. Imagine the additional load on the public schools if all the Christian schools weren’t in operation. Imagine the strain on government if the soup kitchens and outreaches to the poor no longer existed. The list goes on and on.

The secular mindset these days is that religious institutions are getting a free ride because of tax-exemption. Actually, government and public funding are the ones benefiting from all the services provided by these institutions. That is why I think a discussion would be educational for our country.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online