Kerby Anderson

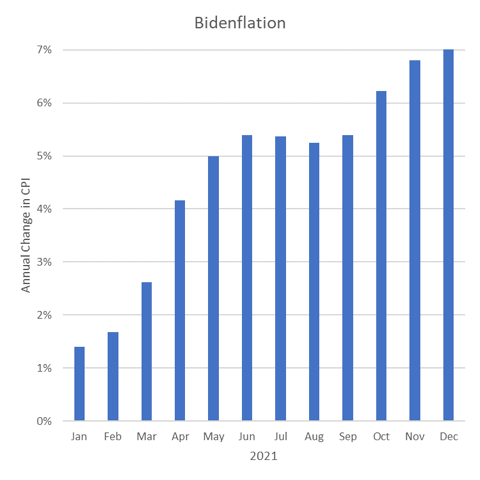

Inflation is a growing problem, and yet our political leaders have very few policy tools they can use to combat it. If you are older, you might remember the inflation of the 1970s, and you might even remember how the Federal Reserve Chairman Paul Volker, with the support of President Ronald Reagan, dealt with it. He increased interest rates and reduced the money supply. Unfortunately, those tools can’t be used this time.

Rod Thomson writes about the “coming financial vise” that illustrates why the solution four decades ago can’t be implemented this time. The current Federal Reserve Chairman Jerome Powell can’t employ the same one-two punch. Paul Volker raised interest rates higher than inflation. By contrast, Jerome Powell is only talking about raising interest rates from 0.25 percent to 0.50 percent.

Why can’t the Federal Reserve raise interest rates higher? The simple answer is the US national debt. I encourage you to look at the US Debt Clock. As I write this, the national debt is $29.7 trillion. The interest we will pay on that debt is $422 billion. I will guarantee that between the time I write this and you go to that website, you will see that those numbers have increased.

Let’s do some simple math. Each one percent increase adds an additional $422 billion. If the Federal Reserve just wanted to raise interest rates to five percent, the interest on the national debt would be $2.1 trillion. That is roughly equal to what the government spends each year on Medicaid, Medicare, and Social Security combined. That is also more than the Federal government takes in each year in income tax revenue.

This illustrates the “financial vise” that is squeezing the federal government and the Federal Reserve in 2022. I also think that is why few in government want to talk about it.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online