By:

Over the past 50 years there have been numerous congressional efforts to reduce budget deficits. Most clearly failed, although some, such as the Clinton-Gingrich agreement of 1997 and the Budget Control Act of 2011, achieved noteworthy savings in their day. Even successful agreements had only marginal effects on long-term national debt. Why? Because with the possible exception of Ronald Reagan and Speaker Tip O’Neill’s Social Security agreement of 1983, those agreements didn’t meaningfully reform spending on entitlements such as Medicare, Medicaid and Social Security.

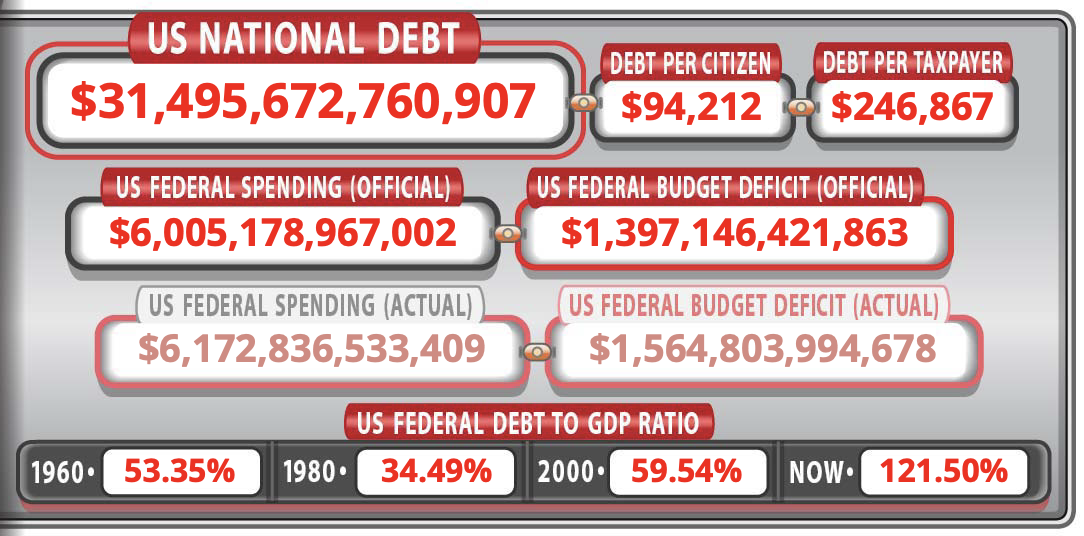

Today entitlement spending comprises 64% of the federal budget and continues to grow unsustainably. With growing global threats to our national security, paring back the defense budget may be off the table; and mandatory interest payments on the national debt are off the table. What remains is 16% of the total federal budget. What has been true for years is even truer today—the impending debt crisis will never be avoided without addressing entitlement programs. It is simple math. Let’s hope the president, who bashed the ideashortly before Election Day, takes note.

Experience also teaches us of the necessity of bipartisanship. In 2005, President George W. Bush championed the cause of personal carve-out accounts in Social Security to maintain its solvency. He did so, however, when government was under unified Republican control. The historic initiative was universally opposed by Democrats, and after fighting a partisan battle for several months, Republicans sounded retreat. Deficit reduction is heavy lifting, but divided government represents more opportunity than impediment.

Mark Twain once wrote that public opinion “settles everything. Some believe it to be the voice of God.” When the ground-breaking Gramm-Rudman Act of 1985, which saved $36 billion annually over five years, was enacted, a Gallup survey indicated that 61% of respondents thought the deficit was a serious problem. The 1997 Clinton-Gingrich budget deal balanced the budget from 1998 to 2001—the last balanced budgets. Leading up to the agreement, more than 60% of Americans thought balancing the budget was very important, according to a 1996 Pew survey. A Gallup poll at the time found 2-to-1 support for the plan.

Today, Americans are connecting the dots between unsustainable deficit spending and historically high inflation. Although not yet hitting the heights of concern of a decade ago, public concern appears to be growing. The Peter J. Peterson Foundation, which conducts a monthly Fiscal Confidence Index, reports in its latest survey that 77% of respondents now believe that Congress should make deficit reduction one of their top three priorities. Perhaps not the voice of God, but history shows that today’s public opinion can help empower lawmakers to do what must be done.

Past experience also shows there is no substitute for having the Sword of Damocles hang over your head during budget negotiations, even if you have to place it there yourself. The budget successes of the 1985 Gramm-Rudman law and the 1990 Andrews Air Force Base agreement would likely never have occurred but for Congress’s placing in the legislation the blunt tool of automatic budget cuts in case of failure. The “Fiscal Cliff” deal of 2013 was concluded against the looming expiration of Mr. Bush’s tax cuts. When Reagan and O’Neill successfully shored up Social Security for decades, recipients were weeks away from a significant statutory benefit cut. The threat of automatic spending cuts or tax increases doesn’t guarantee success in deficit-reduction agreements, but their absence usually brings failure.

In any deficit-reduction deal, Democrats are likely to demand tax increases. Republicans should say no unless dramatic entitlement reforms are offered in exchange. There are too many examples of laws whose promised tax increases are realized and promised spending reductions aren’t. In 2001, the budget was balanced between less spending and more growth, not less spending and higher taxes. Further, at 20% of GDP for fiscal 2022, tax revenue is already near a multidecade high.

Recent experience reminds us of the single most important lesson of deficit reduction: Legislative negligence and political gamesmanship can last only so long in the face of fiscal reality. The U.K. is a clear example, with Liz Truss’s short-lived government proposing an economic plan that threatened a significant increase in the U.K’s debt-to-GDP ratio. Against a backdrop of rising global interest rates and a fragile pension system, that caused bondholders to sprint toward the exit. Yields spiked on sovereign debt, making the debt unmanageable and threatening the broader U.K economy. For those who say this can never happen in the U.S., we just witnessed it in the world’s sixth-largest economy possessing one of the world’s reserve currencies.

“If something cannot go on forever,” economist Herbert Stein observed in 1986, “it will stop.” Stein’s Law hasn’t been repealed. In 2008, the era of no-money-down and “no doc” home loans came to a painful stop, surprising many. Last year the Fed’s experiment in a zero-interest-rate policy and quantitative easing came to a painful stop, also surprising many. One day our debt-to-GDP ratio will have to stop growing. Unless the president and Congress seize the opportunity before them, no one should be surprised when that stop also proves painful.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online