Kerby Anderson

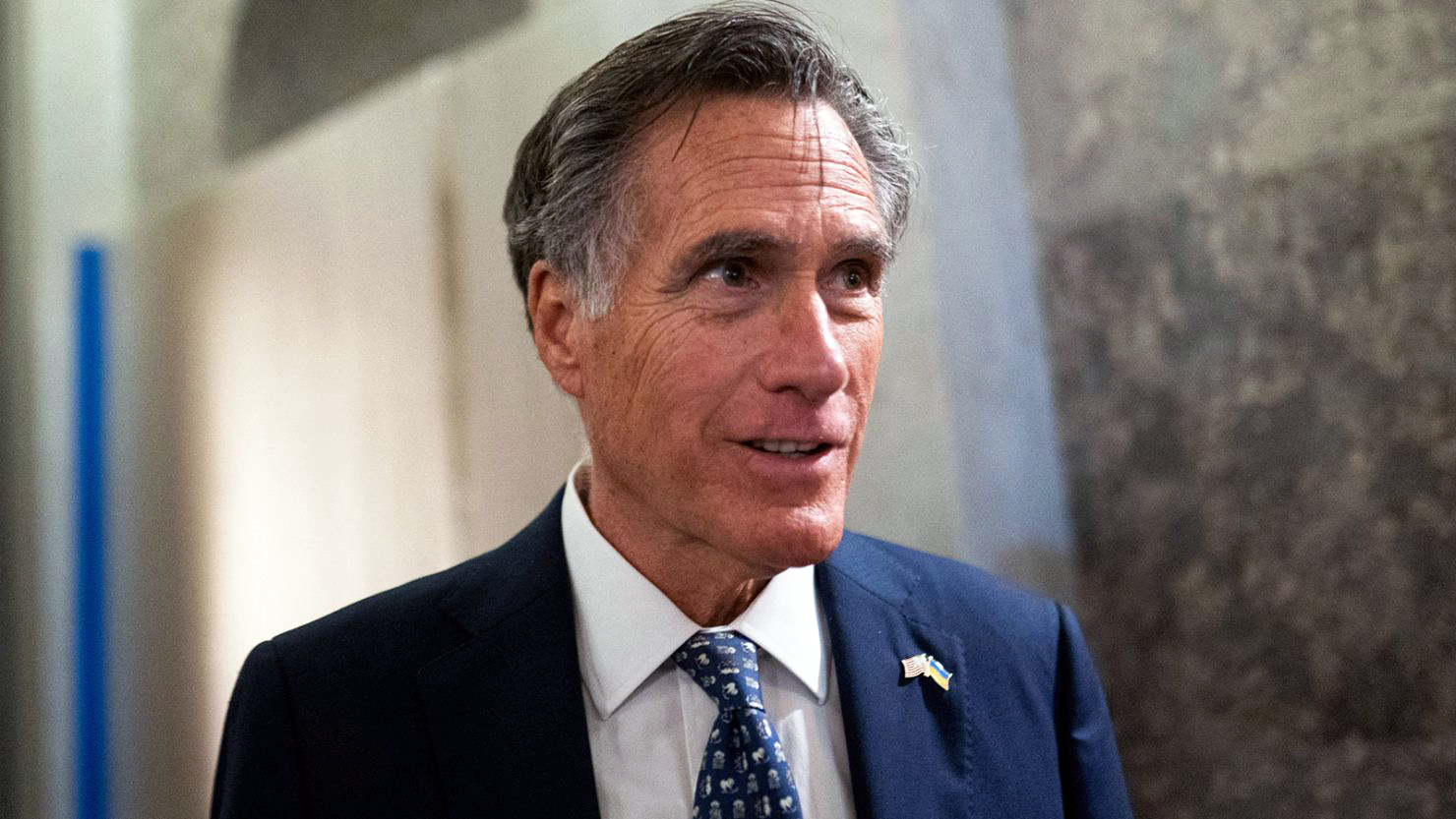

Mitt Romney, writing in The New York Times proclaims, “it’s time for rich people like me to pay more.” Nate Jackson responds: “Feel free to write a larger check to the U.S. Treasury. Go right ahead. No one’s stopping you, or any other rich person.”

The editors of The Wall Street Journal agree but also add “please spare the middle class trying to become rich.” Before he was governor and a presidential candidate, Mitt Romney made his fortune at Bain Capital. “He can afford to pay more. But would the 28-year-old Mitt still on the make have thought so? Raising taxes makes it harder for others to get rich.”

The editors remind us that we have a progressive tax code. The top 1% of earners pay 40.4% of the total income taxes. By contrast, the bottom 50% pay only 3% of all income taxes.

Mitt Romney does make some important points. First, he focuses on the carveouts that benefit the wealthy. The tax code should be cleaner and fairer. He complains about the legal ways very rich people can avoid paying taxes. The Wall Street Journal editors remind us that: “Billionaires like Warren Buffett and Bill Gates are able to shelter their wealth behind tax loopholes.”

Mitt Romney also recognizes that “programs such as Social Security and Medicare account for a majority of government outlays.” He estimates that a third (35%) of government spending funds those two programs, yet they are headed for insolvency in the next decade. He deserves credit for talking about a program most politicians want to ignore.

The U.S. government has a federal debt problem. But it isn’t a revenue problem. It’s a spending problem. Mitt Romney’s comments later in his op-ed focus on the real problem. A simple tax code and entitlement reform are the true solutions to our debt problem.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online