By: The Editorial Board – wsj.com – November 15, 2021

Americans like to be first—in Olympic gold medals, for example—but maybe not in this category: If the $4 trillion House spending bill passes, the U.S. will have the highest combined federal and state personal income tax rate in the developed world.

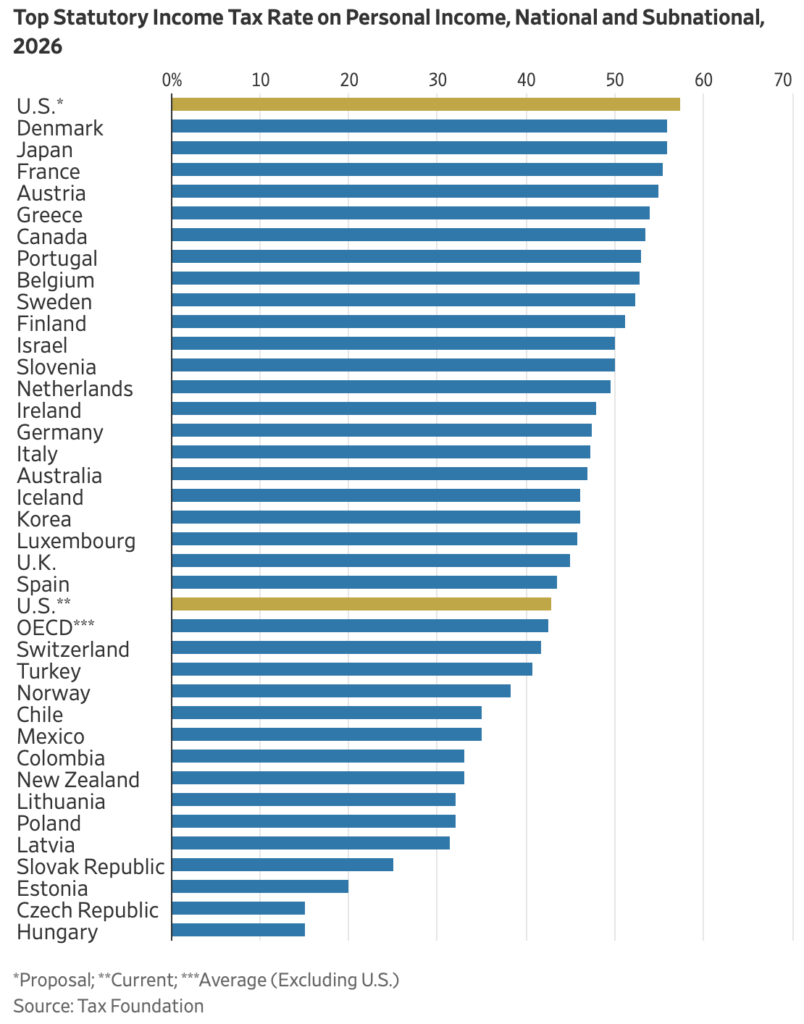

The Tax Foundation recently compared the combined tax rates on individual income at all levels of government across major nations. Today the U.S. is in the middle of the pack with a still very high top rate on income of 42.9%, including federal and average state tax rates. That’s a little above the current Organization for Economic Cooperation and Development average of 42.6%.

But not for long. Under the Democratic plan, the combined U.S. top rate would climb to 57.4% by 2026. The U.S. would leap over 22 other countries in the OECD tax ranking, including Italy (47.2%), Sweden (52.3%), and even France (55.4%). Germany comes in at a relative bargain at 47.2%. Congratulations, America, you’ll be Number One.

The increase would come from the income tax surcharge the bill slaps on the gross income of high earners—a 5% rate on earnings above $10 million and another 3% on income above $25 million. That’s on top of the current 37% top federal tax rate. But unlike the ordinary income tax, the surcharge rates would also apply to non-wage earnings like capital gains, punishing savers who earn a big one-time windfall.

The bill would also expand an existing tax to target more income. Democrats imposed a 3.8% surtax on certain earnings a decade ago as part of ObamaCare, and now President Biden would expand that rate to all taxable business income above $500,000. This is a surtax on small business since many entrepreneurs and sole proprietors pay taxes through the personal income tax code.

And it won’t stop there. The current 37% top rate on ordinary income will rise to 39.6% in 2026, as the individual provisions in the 2017 tax reform are scheduled to expire. Add up these changes plus the 6% average top state tax, and you get the eye-popping 57.4% rate.

This is the compromise that Democrats settled on after Democratic Sen. Kyrsten Sinema opposed an increase in the current rates for individual and corporate income. The surcharges will spare many affluent earners who make less than $5 million from a tax-rate increase, though they’ll pay in other ways.

That doesn’t mean these surcharges are benign and won’t affect everyone else. The high-tax rates will distort work and investment decisions for high earners, who will seek out ways to shelter their income from the high marginal rates. The surcharges will also increase the incentive for the highest earners to relocate from high-tax New York and California, to states with no income tax such as Texas, Nevada or Florida.

We’ve been here before, alas. A previous bout of envy politics in the middle of the last century pushed the top income tax rate above 90%. But over time that crazy high rate yielded less and less revenue as rich taxpayers, aided by Congress, found ways to dodge them.

That’s one reason John F. Kennedy proposed, and Congress passed, a cut in the top tax rate to 70% from 91% on income over $100,000 (about $848,000 in 2021 dollars) for individual tax filers. The Kennedy tax cuts triggered the 1960s economic boom.

Ronald Reagan continued the march down in 1981, cutting the top rate to 50%, and again with the tax reform of 1986 that cut the top rate to 28%. Those cuts triggered another decade of rapid economic growth, with tax revenue flooding into the Treasury.

We realize it’s impolite to mention this tax history these days since we live in an era when the wealthy are supposed to be punished for their own sake. Which means we may have to learn these lessons in economic reality again the hard way—from painful experience.

To see this article and subscribe to others like it, choose to read more.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online