By: Aaron Zitner, Jon Kamp, and Brian McGill – wsj.com – September 30, 2024

An aging population and economic distress have increased dependence on federal and state support. Here’s why that matters for the 2024 election.

The country hasn’t always been this reliant on government support. In 1970, government safety-net money accounted for significant income in fewer than 1% of America’s counties, new research by the bipartisan think tank Economic Innovation Group finds.

These counties, colored here in gold, were among the nation’s most economically distressed, such as those in Appalachia.

As America’s population aged, more counties came to count on this government backing for a significant share of their total income. That is defined by EIG, the think tank, as those in which government safety-net and social programs account for 25% or more of personal income in the county.

By 2000, roughly one in 10 counties drew a significant share of their income from federal and state safety-net and social programs.

By 2022, 53%—more than half of all U.S counties—drew at least a quarter of their income from government aid.

Source: Economic Innovation Group analysis of Bureau of Economic Analysis data

The big reasons for this dramatic growth: A much larger share of Americans are seniors, and their healthcare costs have risen. At the same time, many communities have suffered from economic decline because of challenges including the loss of manufacturing, leaving government money as a larger share of people’s income in such places.

For its analysis of government spending, EIG used a government definition of income that includes spending on programs that Americans pay into, such as Medicare and Social Security. Another major government health program—Medicaid—is also counted.

The analysis also includes unemployment insurance, food stamps, the earned income tax credit, veterans benefits, Pell grants, Covid-era payments and other income support. States help pay for some of these programs, such as Medicaid, but the federal government covers roughly 70% of the total cost.

The EIG analysis doesn’t include other ways government spending floods into corners of America, such as through farm subsidies or military bases.

This spending accounts for a big and growing share of the national debt. But this year’s presidential candidates, Democrat Kamala Harris and Republican Donald Trump, have said little about reining it in. In fact, both have offered plans that would add to the costs. Trump would end taxes on Social Security benefits. Harris would expand the Earned Income Tax Credit for lower-income workers and extend Affordable Care Act subsidies that are due to expire, among other proposals.

The data help explain why. Though counties that rely significantly on government spending tend to be small, they are still home to nearly 22% of the U.S. population.

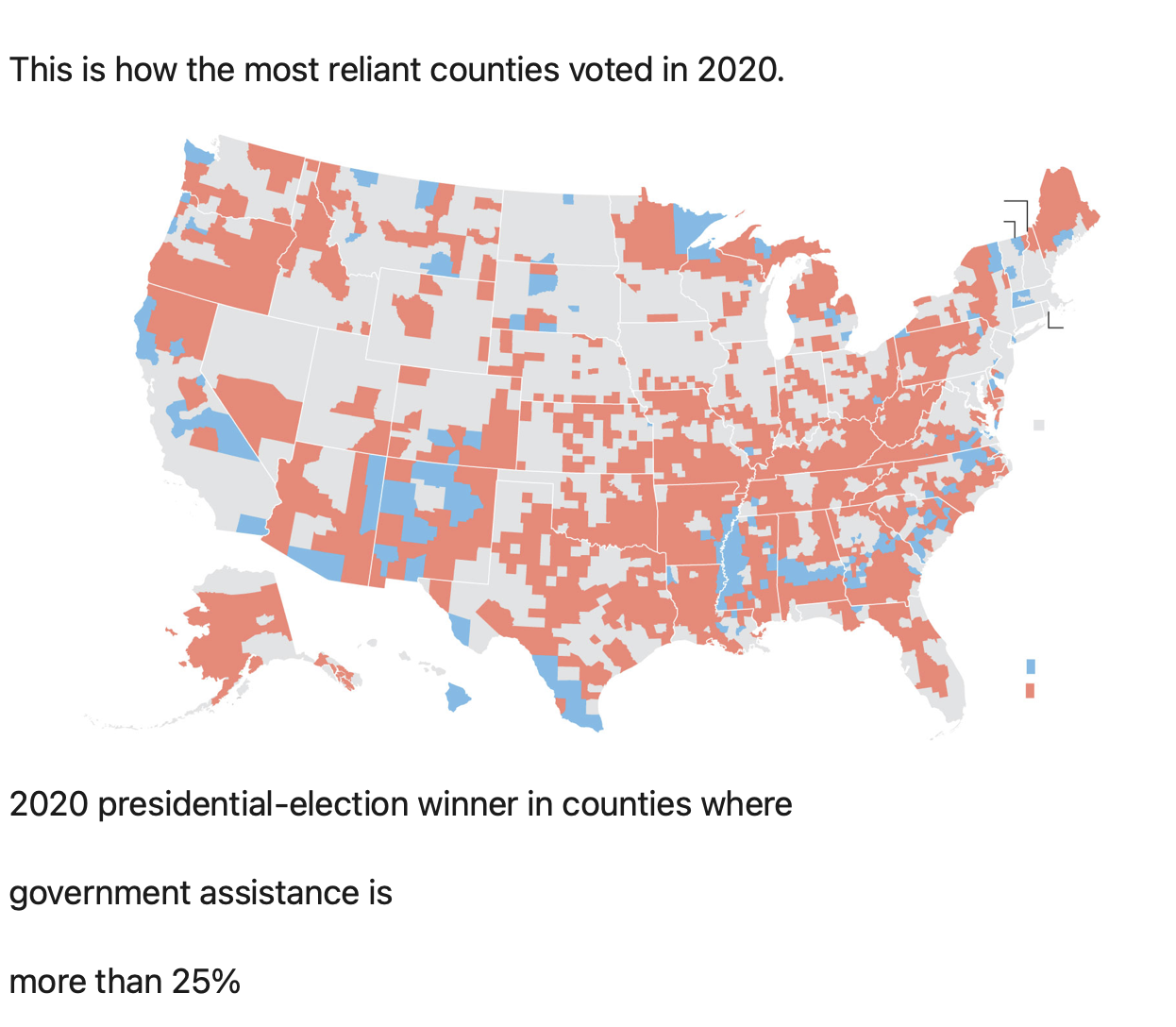

The growth in these counties has been far more concentrated in places that vote for Republicans or have shifted that way.

The map of government spending also helps explain the rise of Donald Trump. He not only has promised to revive America’s economically stagnating communities, but to protect Social Security or Medicare from “even a single penny’’ of cuts. That stance was a departure from that of prior Republican leaders, who pushed to curb spending, in some cases by cutting benefits for future retirees.

Many of the counties that rely heavily on government safety-net and social-program money have this in common: They are clustered in the battleground states that will decide the presidential election.

About 70% of counties in Michigan, Georgia and North Carolina are significantly reliant on the government income. So are nearly 60% of counties in Pennsylvania. In Arizona, 13 of the 15 counties are heavily reliant on safety-net income.

Measured another way, more than 44% of Michiganders live in counties that are significantly reliant on the government programs. In Arizona, Pennsylvania and North Carolina, more than a third of the populations live in such counties.

Trump has visited Johnstown, Pa., in all three of his presidential campaigns, promising economic renewal. A former steel powerhouse, the city and surrounding Cambria County lost jobs as industry collapsed, prompting businesses to close and workers to leave for opportunities elsewhere. The city has shed more than half its population since 1970.

The number of workers has fallen more than 10% since 2000. So has the number of business establishments.

Renewal hasn’t arrived, and voters in the county have increasingly supported Republican candidates for president. Trump won 68% of the vote in 2020.

About 35% of county income comes from federal and state safety-net payment and social programs, one of the highest shares in the state.

Like much of Pennsylvania, the counties of Northern Michigan are heavily reliant on government money. But Leelanau County, which juts into Lake Michigan, stands out as different.

It has something in common with Cambria: a lot of seniors, who are beneficiaries of Social Security and Medicare. Seniors make up 35% of the residents in Leelanau County, compared with 25% in Cambria.

And yet government social and safety-net income accounts for 16% of total income in Leelanau County, compared with 35% for Cambria County. This is largely because people in Leelanau—a popular retirement and tourism destination—have much higher underlying incomes. The population there has risen 6% since 2010.

And where Cambria County voters swung more heavily toward Trump in 2020 compared with 2016, voters in Leelanau shifted Democratic.

Wake County, N.C., presents a very different picture. Fast-growing and home to state capital Raleigh, the biggest county in North Carolina relies on government support for only about 10% of income. The young population is a big help—only 13% of Wake County’s population is at least 65 years old, far below the national share—meaning residents aren’t heavily tapping government programs for seniors.

About 14% of people there were born in another country, roughly matching the U.S. level. EIG’s data shows that counties with more immigrants tend to rely less on the government programs EIG tallied, while counties with small foreign-born populations tend to rely more on this government spending.

Since 2008, the county has backed Democrats for president while turning steadily bluer. Biden won 62% of the vote in 2020.

Government spending to help address poverty also contributes to the trend of increasing reliance, especially during economic downturns. But poverty in the U.S. has been relatively stable while the population grows older. Meanwhile, the costs of an aging population are rising.

Today, more than 17% of Americans are ages 65 or older, up from about 10% in 1970.

Federal and state spending on social and safety-net programs

Spending on these programs has outpaced the income people earn from other sources, the EIG analysis shows. Meanwhile, pressure from a graying population won’t let up: By 2060, nearly a quarter of the U.S. will be at least 65, the Census Bureau projects.

METHODOLOGY

This analysis includes a broad range of government spending known as transfer receipts, as defined by the federal Bureau of Economic Analysis. Medicare and Social Security are included in the BEA definition of transfers, which are benefits “for which no current services are performed,” according to the agency.

The think tank Economic Innovation Group counted that spending as a form of income, as the government does, and combined it with income from other sources, including employment and investments, to determine total personal income.

The analysis compares income from government transfers in a given county with personal income from all sources in that county. In doing so, it provides a measure of the economic health of a county by showing how much income there comes from transfers.

To see this article in its entirety and to subscribe to others like it, please choose to read more.

Source: Exclusive | Americans Are More Reliant Than Ever on Government Aid – WSJ

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online