By: Vance Ginn – vanceginn.com – September 14, 2018

Despite the economic success of the Texas Model of relatively fiscally conservative governance, a skyrocketing local property tax burden remains one of the state’s most pressing policy challenges.

While Texans have the luxury of not paying a state personal income tax, which should be constitutionally banned, they’re currently weighed down by more than 5,100 local taxing jurisdictions that boast the sixth highest property tax rate nationwide. These locally-determined tax rates along with often subjectively appraised property values combine to give the total property tax levy statewide of $56 billion in 2016—contributing to an average property tax burden of more than $8,000 per year for families of four.

Although many Texans live in uncertainty year-to-year on what their property tax bill will be, much of the damage of such ominous tax burdens are not so uncertain: discouraged economic growth, distorted investment decisions, depressed job creation, and ultimately renting property from the government forever.

While the pain is felt statewide, it’s particularly felt among housing-rich but income-poor individuals, such as the elderly, who often must move as increasing tax liabilities extend beyond their means. In fact, some Texans who have paid off their mortgage now pay more for their property tax liability than prior mortgage payments, forcing them out of their home. The high property tax burden also keeps some people from ever having the means with which to purchase property.

Both of these issues limit the liberty and economic prosperity of Texans from property taxes at often no fault of their own. This is particularly harmful because people aren’t able to ever own their home but rather pay rent to the government forever.

And even those who do not have property are burdened as renters can reasonably expect property managers to pass the tax along to them and consumers pay more goods and services as business owners do the same.

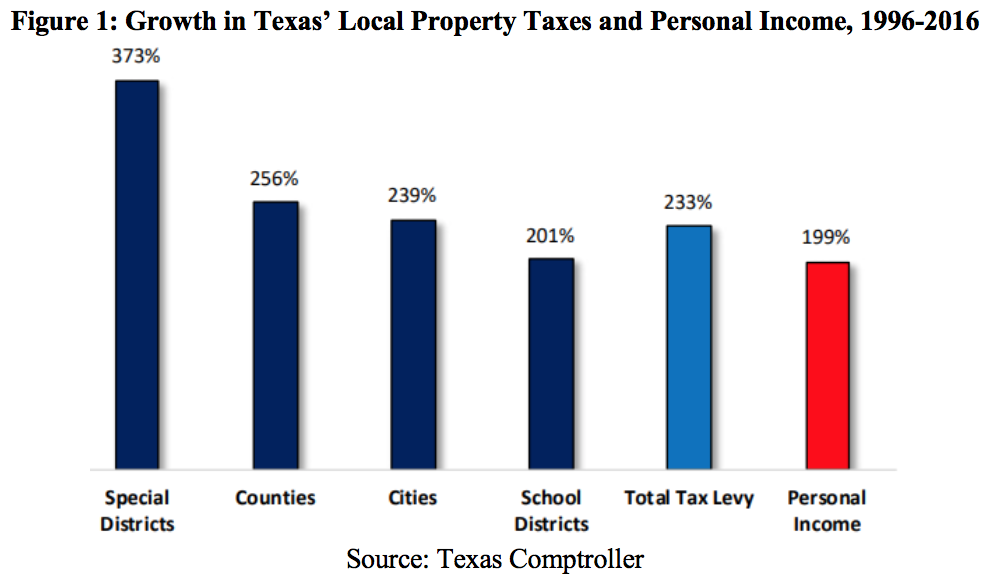

The culmination of these increases by local tax jurisdictions contribute to the total property tax levy statewide increasing by 233 percent to $56 billion in property taxes collected in 2016—the single largest tax imposed in the Lone Star State. For comparison, there may be a need for increasing spending and therefore taxes to fund increases in population and inflation.

However, in this period, the state’s population growth increased by 47 percent and price inflation increased by 53 percent—collectively well below the increase in property taxes.

On an average annual basis, the total property tax levy increased by 6.3 percent during that period; however, population growth increased by 1.9 percent and price inflation increased by 2.2 percent. Again, these growth rates indicate the mounting burden on Texans compared with a potentially reasonable argument for spending and taxing more.

With many local tax jurisdictions raising property taxes at rates that are outpacing key measures of Texans’ ability to pay, the Texas Legislature has attempted to limit the growth of property taxes but to little avail. The steady increase in the property tax burden despite these unsuccessful attempts signal the real issue: Texas’ local governments don’t have a revenue problem, they have a spending problem.

By first identifying this spending problem, we can begin to discuss real property tax relief.

To see this article, click read more.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online