Live Updates – wsj.com – August 5, 2024

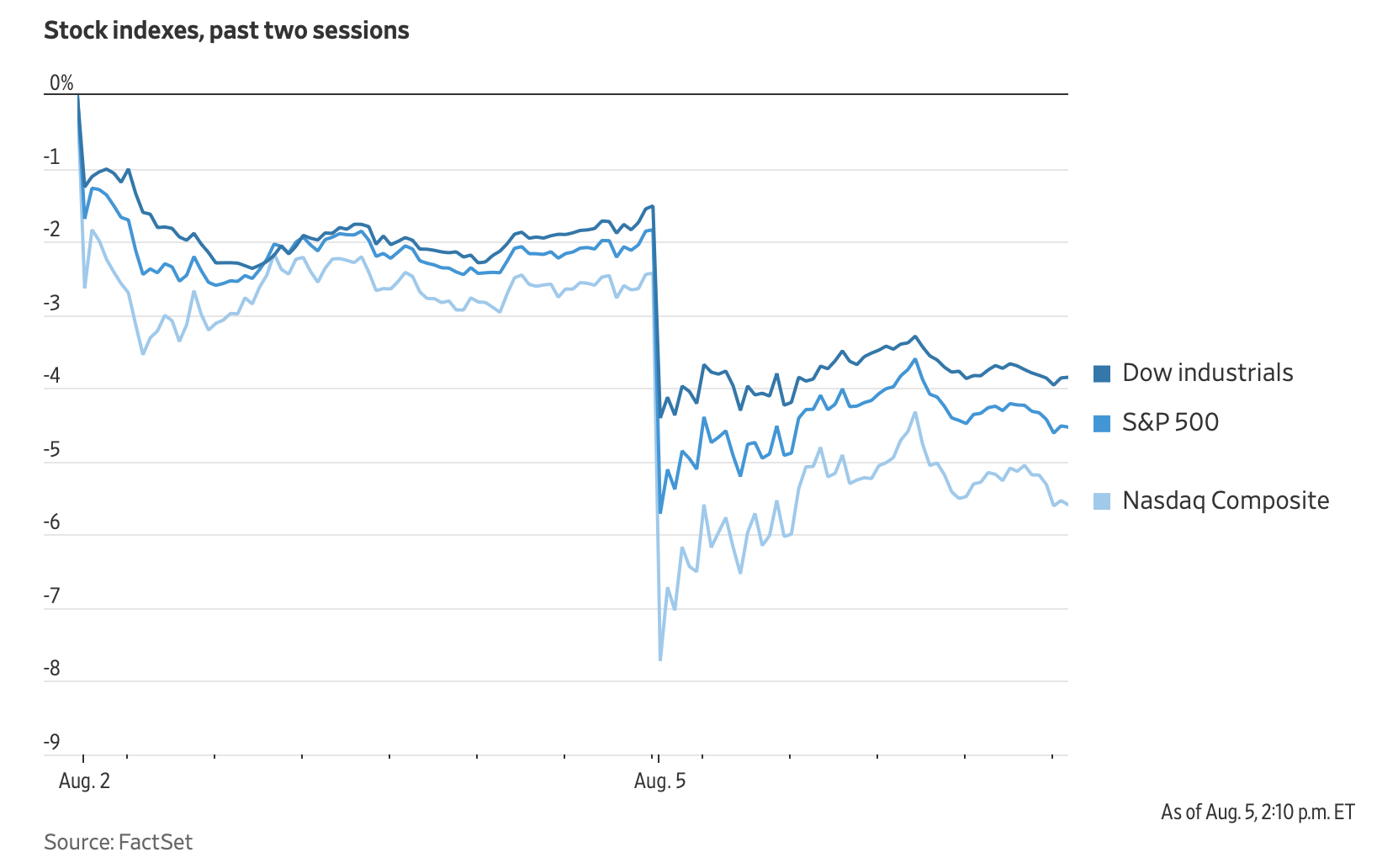

A stock-market selloff extended around the world, with U.S. indexes sliding and volatility spiking.

All three major indexes fell more than 2%, with the Nasdaq Composite leading losses. Stocks and Treasury yields pared declines after service-sector data came in better than expected.

Turbulence started in Japan, where the Nikkei 225 fell more than 12%, its worst one-day drop since the crash after Black Monday in 1987. Losses cascaded across Europe and the U.S., as investors dumped riskier assets.

The declines extended what has been a dizzying few days on Wall Street during which this year’s most popular trades have been aggressively unwound. A selloff in tech shares continued Monday, with Nvidia, Tesla and Apple each falling at least 4%. (The iPhone maker took an extra hit from news that Berkshire Hathaway had slashed its Apple stake.)

Concerns about a slowing U.S. economy are front and center after job growth slowed sharply in July. Investors are worried that the Federal Reserve has moved too slowly and will need to play catch up in cutting rates.

To see this article in its entirety and to subscribe to others like it, please choose to read more.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online