Kerby Anderson

Inflation has been so much a part of our economic lives, so we take it for granted. Although the Federal Reserve aims for an inflation target of 2 percent, some economists are suggesting we should reexamine that target especially since we won’t be hitting it very soon.

Two years ago, I mentioned a book by Jeff Booth. In the The Price of Tomorrow, he argues that we should be seeing deflation in our society. His argument is simple: Technology is deflationary. That is the nature of technology.

Think about cell phones. He explains that his first cell phone (which was a Motorola 8000). “It had thirty minutes of talk time before it needed to be charged for ten to twelve hours, and it cost about $2,000.” Think of the cell phone in your hand today.

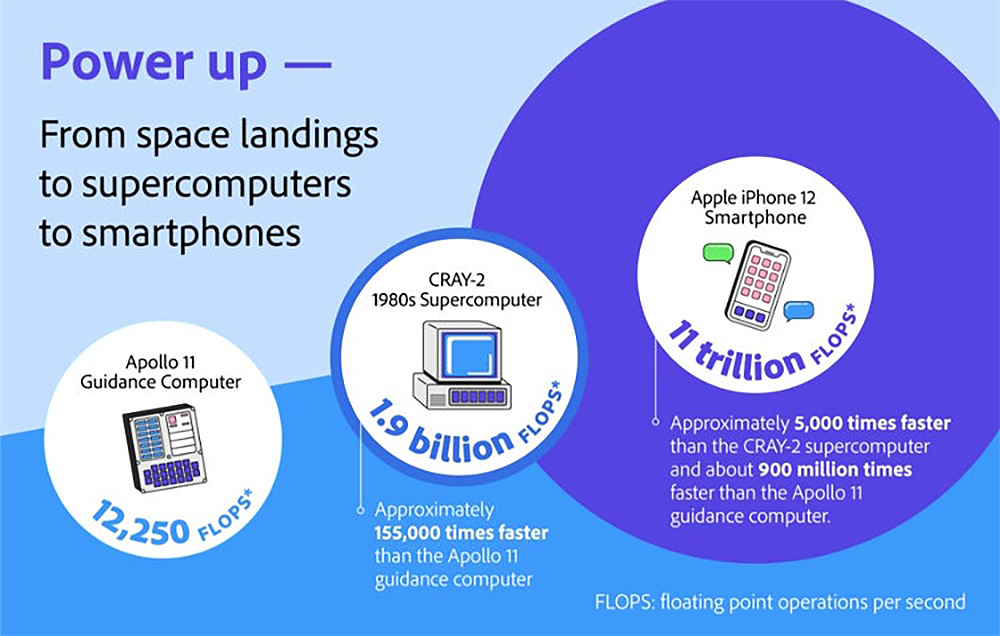

While we are talking about cell phones, perhaps you have seen the graphic that compares the Apollo 11 computer with the Apple iPhone. The Apollo guidance computer used 12,250 flops (floating point operations per second). The Apple iPhone 12 now processes 11 trillion flops. It is 900 million times faster than the Apollo computer and also a fraction of the cost.

Jeff Booth reminds us, “Our economic systems were not built for a world driven by technology where prices keep falling. They were built for a pre-technology era where labor and capital were inextricably linked, an era that counted on growth and inflation, an era where we made money from scarcity and inefficiency.”

We should be experiencing deflation, which is a world where you get more for your money. But we have inflation due to money printing and the declining value of the dollar. Perhaps it is time to rethink how we do this economy.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online