Kerby Anderson

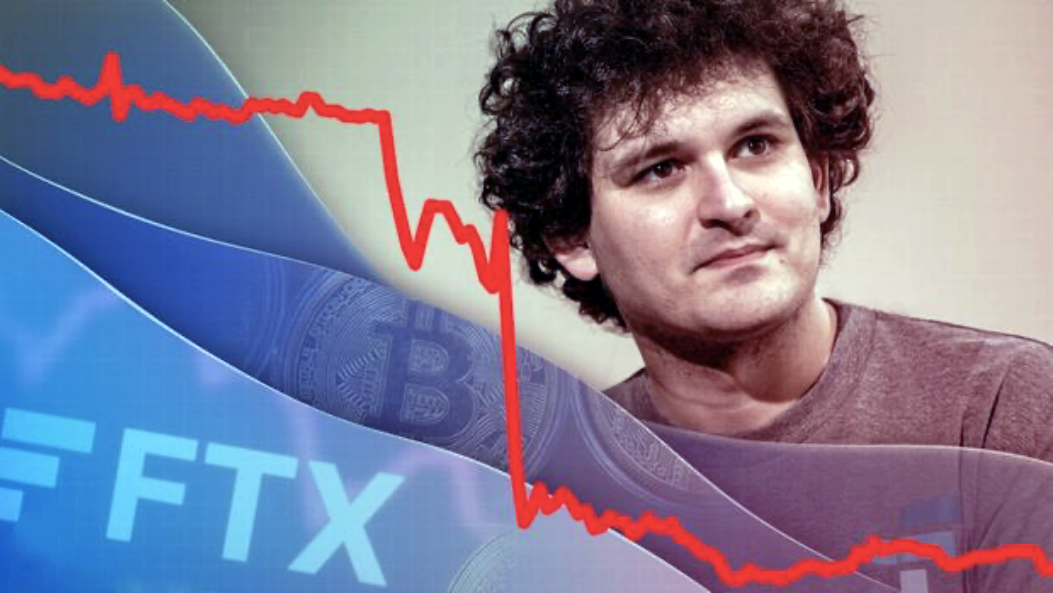

Anyone wondering if cryptocurrency regulation was coming soon need look no further than the FTX scandal that unfolded this month. Sam Bankman-Fried founded FTX in 2019. A few months ago, he was called the “J.P. Morgan of crypto.” Now he is being called the Bernie Madoff of crypto.

The financial issues surrounding the scandal are significant, but so are the moral issues. The founder was one of 10 roommates involved in various sexual relationships with each other while they lived in a $40 million penthouse in the Bahamas. In fact, his girlfriend, Caroline Ellison, ran a related business known as Alameda. Her father at MIT used to be the boss of Gary Gensler, who is the current head of the SEC.

The FTX scandal unfolded earlier this month when CoinDesk was reporting that much of the wealth in Alameda rested on a created FTT token invented by the sister company, FTX. First, FTX withdrawals were halted. Then, FTX filed for bankruptcy. FTX and Alameda have more than 100,000 creditors.

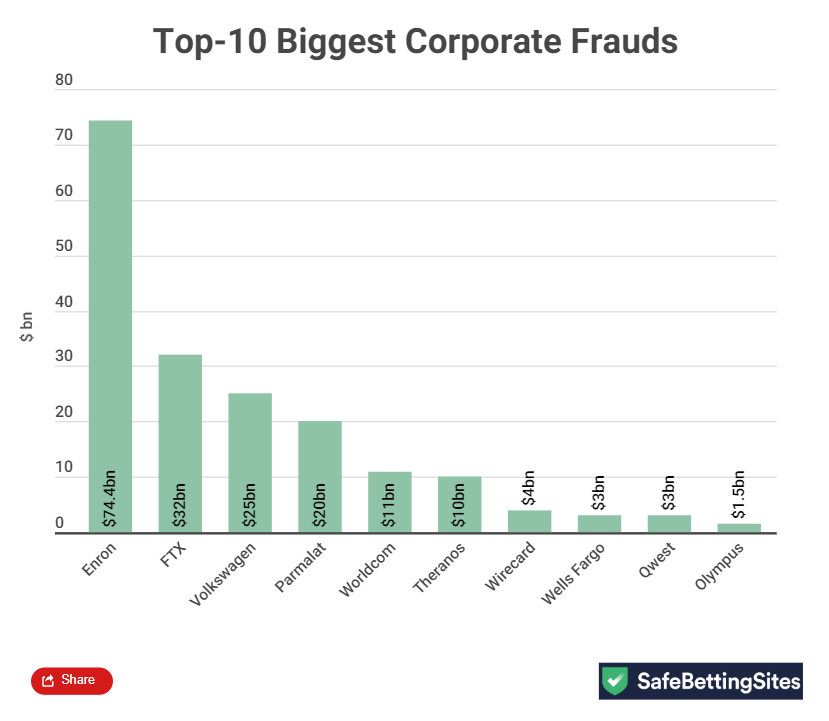

After FTX filed for bankruptcy, John Jay Ray (who is running what’s left of the company) declared in the bankruptcy filing that no one at FTX left any records. In the past, he oversaw the dismantling of Enron after its massive fraud. He wrote that “never in my career have I seen such a complete failure of corporate controls and seen such a complete absence of trustworthy financial information as occurred here.”

The FTX scandal follows the collapse of other exchanges like Terra Luna and Celsius. Government regulation of cryptocurrency is likely now that this financial disaster has struck both this industry and the larger financial world.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online