Kerby Anderson

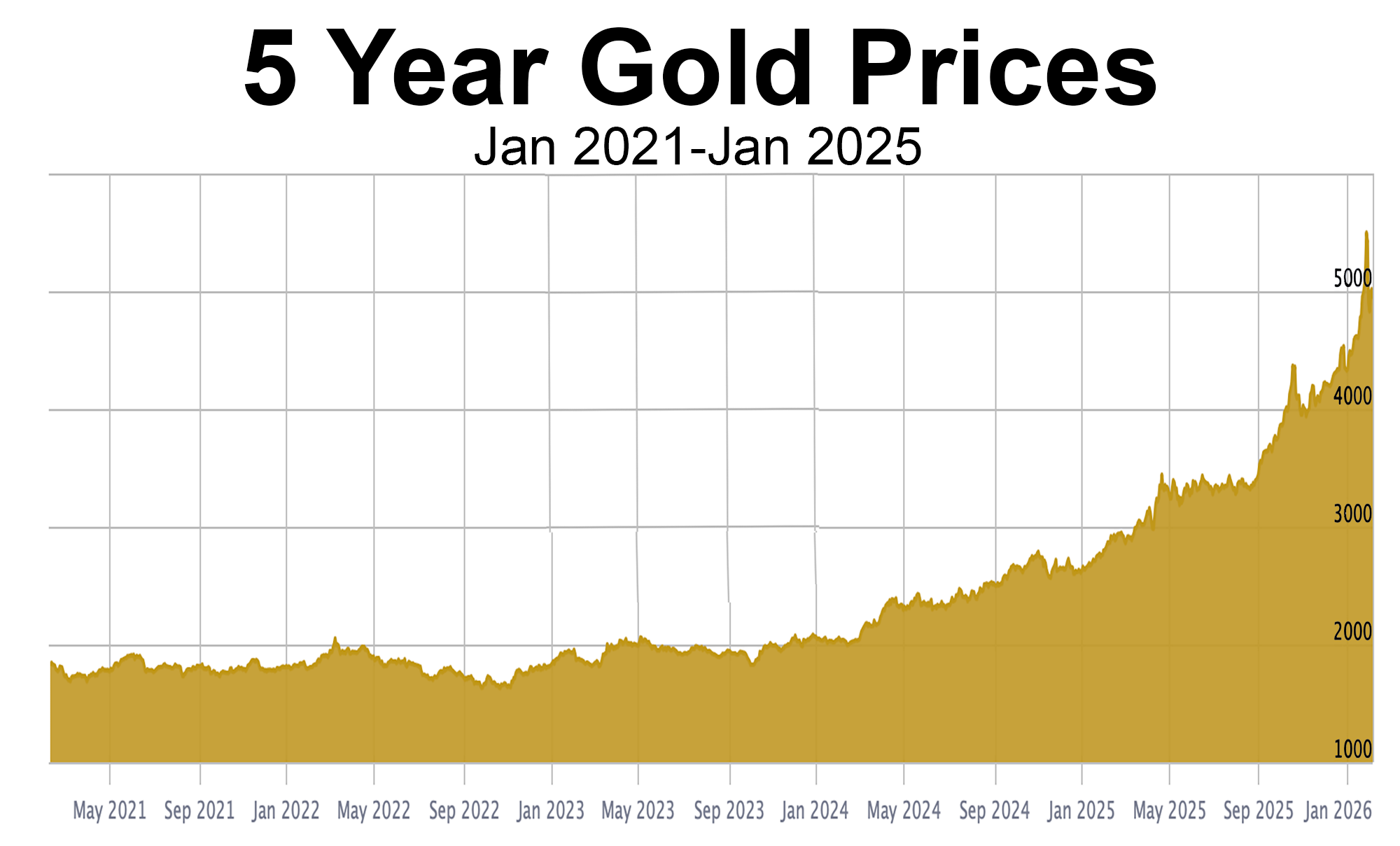

A few weeks ago, the price of gold shot past $5,000 per ounce. President Trump has been proclaiming that the country is entering into a new golden age. I don’t think this is what he was talking about.

Some say that gold is a barometer of belief, while others say it is a vote of declining confidence by the market. It isn’t just that gold is $5,000 an ounce. It is also a recognition that the dollar is now only worth 1/5,000 of an ounce of gold. As some gold investors say, gold has no top because the US dollar has no bottom.

Critics of President Trump maintain that this economic shock is due to his tariffs and his on-again, off again trade war. But the national debt when he took office last year was already $36 trillion. The dollar has been the reserve currency since the 1944 Bretton Woods Agreement.

While it is true that America has a debt problem, the rest of the world has an even greater problem. Look at the bond shock in Japan. Investors used to engage in what was called the “Japan carry trade” in which they would borrow Japanese Yen at ultra-low interest rates and invest them elsewhere. That strategy is over. It look like the US is going to buy Japanese Yen just to keep Japan’s economy afloat.

A week ago, I talked about the pessimism among government leaders at the World Economic Forum. Leaders in Europe and Asia have similar debt problems. A recent article estimates that “the ratio of China’s debt to GDP rose to more than 300 percent last year.” Total global debt exceeds $300 trillion.

The reason the price of gold is rising is due to the value of the dollar and other currencies falling.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online