Kerby Anderson

In America, we are facing a housing divide. We talk about a digital divide that illustrates the gulf between those who have computers and the Internet, and those who don’t. There is a growing divide between those who have homes and those who do not and may never own a home.

Baby boomers are sitting on a staggering amount of housing wealth, estimated at $19 trillion worth of real estate. They hold nearly half of the nation’s real estate wealth. This is due to decades of home ownership and rising property values.

One survey found that 62 percent of baby boomers feel they have gained more wealth from their homes than from their careers. For them, their home equity represents the primary source of retirement income.

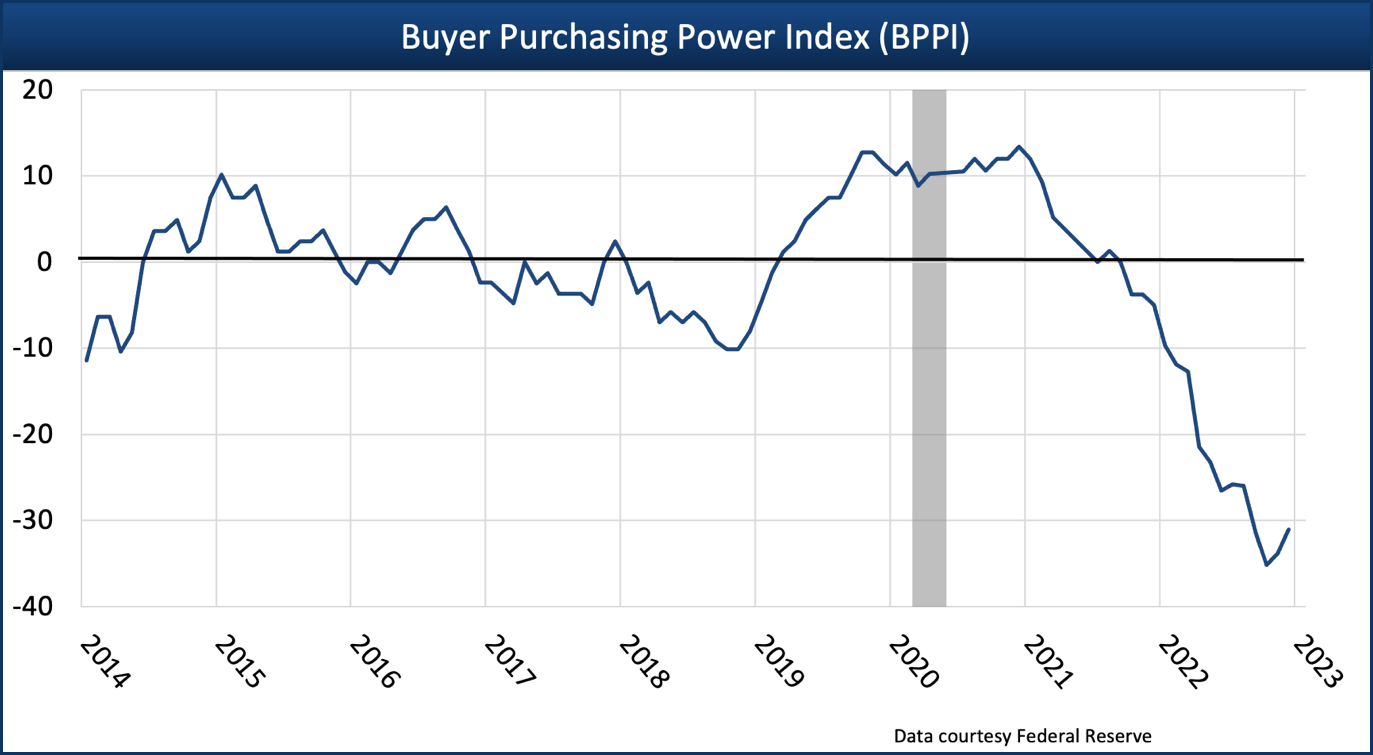

On the other hand, the latest statistics indicate the U.S. housing market has reached is most unaffordable level in history. Homeownership is moving further out of reach for more Americans.

Record-high home prices and high mortgage rates have combined to outpace wage growth. In fact, Americans need to earn about 70 percent more today than six years ago to afford a median-priced home.

The latest report from Realtor.com shows that only 28 percent of homes currently for sale across the country are affordable for the typical U.S. household. This is attributed to the increase in the number of people who want to buy homes coupled with the fact developers have underbuilt.

All of that may be true, but it ignores the obvious reason. The price of homes is going up because the value of the dollar is going down. It takes more dollars to buy the same home a decade later. And as inflation rises, wages never keep up.

The housing divide is due to a government spending too much and the Federal Reserve printing too much.

Listen Online

Listen Online Watch Online

Watch Online Find a Station in Your Area

Find a Station in Your Area

Listen Now

Listen Now Watch Online

Watch Online